👉September Answers and Trivia

👉August Answers and Trivia

👉July Answers and Trivia

👉Jun Answers and Trivia

👉May Answers and Trivia

👉April Answers and Trivia

👉March Answers and Trivia

👉February Answers and Trivia

👉January Answers and Trivia

XENEA Wallet features a Daily Quiz that enhances user engagement while offering a fun and gamified way to learn about Web3 and the Xenea ecosystem.

Although many kind individuals are sharing answers on X (formerly Twitter), it feels like the quiz is turning into a game of simply picking the right answer without understanding the questions. To address this, this article will provide not only the answers to XENEA Wallet’s Daily Quiz but also the reasoning behind them and additional insights. By leveraging XENEA Wallet NAVI (ChatGPT), we aim to make the experience more informative and meaningful.

It takes less than a minute, so bookmark this page and check back daily! 😊

Start Your Journey with XENEA Wallet Today!

XENEA Wallet is an innovative app that makes exploring the world of Web3 both fun and rewarding! Complete simple missions, claim daily bonuses, and earn rewards while learning about the future of digital technology.

With cutting-edge security and unparalleled convenience, XENEA Wallet offers you the chance to participate in future airdrops and mining opportunities. Simply download the app to begin your new digital experience!

New users can start with 1,000 gems by signing up with the invite code below!

1️⃣ Download the app

2️⃣ Enter the invite code: h3dYzHejPI

3️⃣ Sign up with your Google or Apple account

Enjoy the exciting world of XENEA Wallet!

Please refer to the following page for information on how to earn Gems.

How many days does it take to earn 10,000 gems and start automatic mining with the XENEA Wallet?

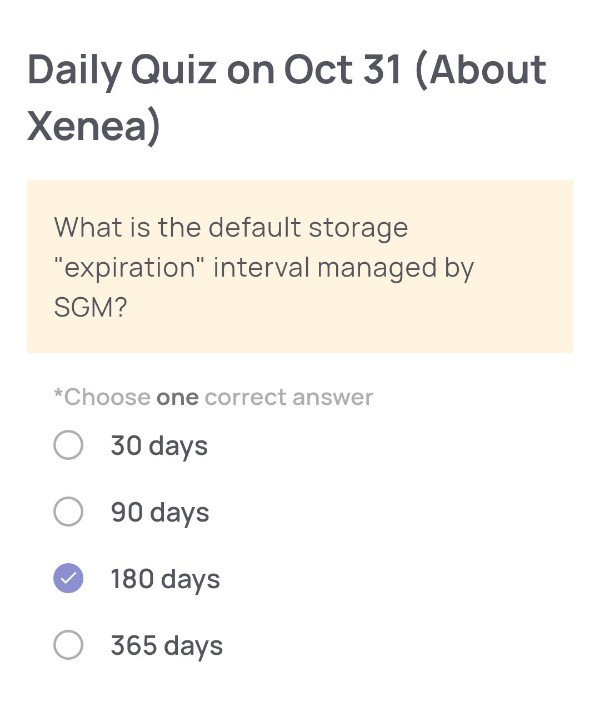

Daily Quiz on October 31

(About Xenea)

🟢Quiz Question:

What is the default storage “expiration” interval managed by SGM?

🟢Choose one correct answer:

・30 days

・90 days

・180 days

・365 days

🟢Answer:

180 days

🟢Reason for choosing this answer:

According to the Xenea White Paper, the Sustainable Generation Manager (SGM) automatically replicates and migrates stored data every 180 days by default. After this interval, the data on the original DACS node is replicated to a new node, and the first-generation storage is cleared for new use. This cycle ensures perpetual data preservation and efficient use of decentralized storage resources.

🟢Trivia:

SGM is a core component of Xenea’s DACS (Decentralized Autonomous Content Storage) system. Its role is to maintain long-term data sustainability by automatically moving data to new storage nodes before hardware deterioration occurs. The expiration interval (default 180 days) can be customized between 1 and 365 days, allowing developers or institutions to fine-tune their data retention strategy according to specific durability or access needs. This design helps Xenea achieve its goal of ensuring that digital assets can be securely inherited across generations.

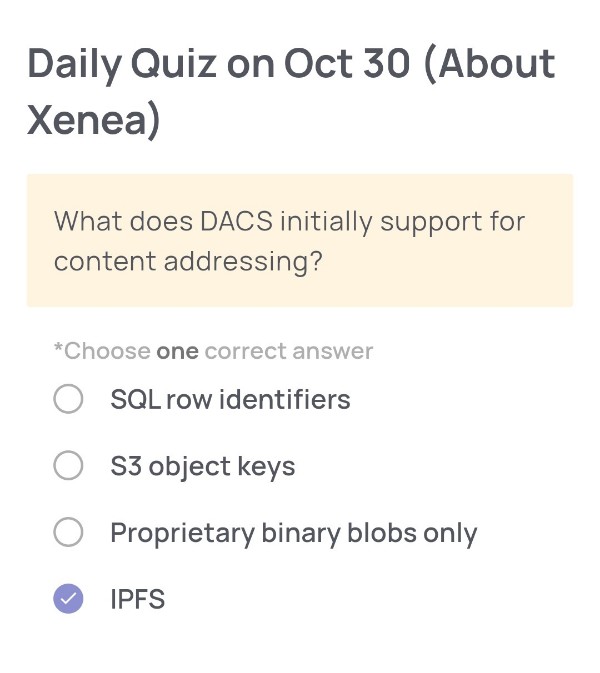

Daily Quiz on October 30

(About Xenea)

🟢Quiz Questions:

What does DACS(Decentralized Autonomous Content Storage) initially support for content addressing?

🟢Choose one correct answer:

・SQL row identifiers

・S3 object keys

・Proprietary binary blobs only

・IPFS

🟢Answer:

IPFS

🟢Reason for choosing this answer:

According to the official Xenea documentation and the 2025 memo, DACS is described as “initially compatible with IPFS and set to expand its support to include other file systems”. This means that at its launch stage, DACS uses IPFS (InterPlanetary File System) for content addressing — a system that identifies and retrieves files based on their content hash rather than their location, aligning perfectly with Xenea’s decentralized design philosophy.

🟢Trivia:

IPFS (InterPlanetary File System) is a peer-to-peer distributed file system designed to make the web faster, safer, and more open. Unlike traditional HTTP, which locates files by server address, IPFS locates files by content hash — meaning that the same content can be shared and retrieved from multiple nodes. By leveraging IPFS, Xenea’s DACS ensures immutability, persistence, and independence from centralized servers — essential qualities for long-term blockchain-based data storage.

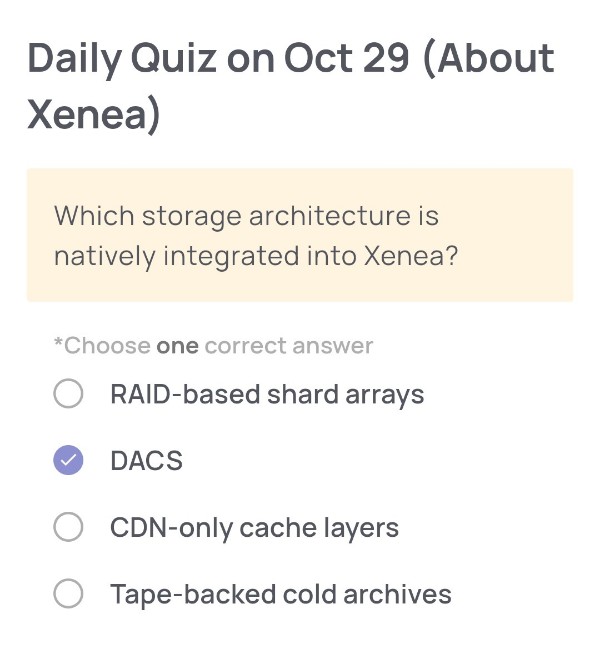

Daily Quiz on October 29

(About Xenea)

🟢Quiz Question:

Which storage architecture is natively integrated into Xenea?

🟢Choose one correct answer:

・RAID-based shard arrays

・DACS

・CDN-only cache layers

・Tape-backed cold archives

🟢Answer:

DACS

🟢Reason for choosing this answer:

Xenea integrates DACS (Decentralized Autonomous Content Storage) directly into its Layer 1 blockchain as its native decentralized storage system. DACS ensures secure, persistent, and autonomous data storage, forming the backbone of Xenea’s architecture. It allows data to be stored, managed, and accessed on-chain without relying on external centralized servers or third-party storage networks like traditional RAID arrays or CDN caches.

🟢Trivia:

DACS was developed to overcome the lifespan limitation of physical storage media found in systems like IPFS. It supports real-time editing of dynamic data, making it suitable for AI, DePIN, and long-term data preservation use cases. According to Xenea’s 2024 documentation, DACS will soon expand beyond IPFS compatibility to integrate its own hash file system, ensuring multi-generational data continuity and secure decentralized file persistence.

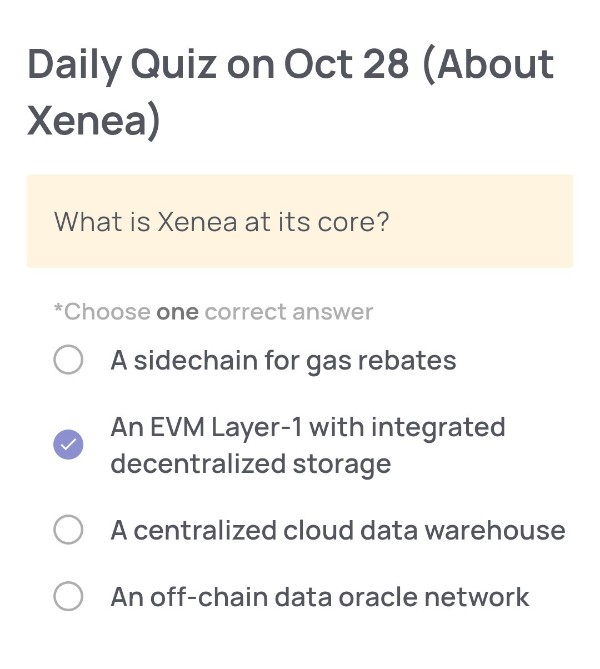

Daily Quiz on October 28

(About Xenea)

🟢Quiz Question:

What is Xenea at its core?

🟢Choose one correct answer:

・A sidechain for gas rebates

・An EVM Layer-1 with integrated decentralized storage

・A centralized cloud data warehouse

・An off-chain data oracle network

🟢Answer:

An EVM Layer-1 with integrated decentralized storage

🟢Reason for choosing this answer:

According to the 2024 Xenea Blog and Xenea Whitepaper, Xenea is described as an EVM-compatible Layer 1 blockchain that integrates decentralized storage to support dynamic and long-term data management.

It combines blockchain and decentralized storage into one unified architecture, enabling real-time data editing and ultra-long-term data preservation, distinguishing it from sidechains, cloud data systems, or oracle networks.

🟢Trivia:

Xenea’s storage system, called DACS (Decentralized Autonomous Content Storage), is directly embedded into its Layer 1 blockchain — a world-first approach.

This integration allows Xenea to securely store AI-generated and real-world data directly on-chain while maintaining EVM compatibility.

The blockchain also uses a unique consensus mechanism called Proof of Democracy (PoD), allowing fair participation and reducing energy consumption compared to Proof of Work or Proof of Stake systems.

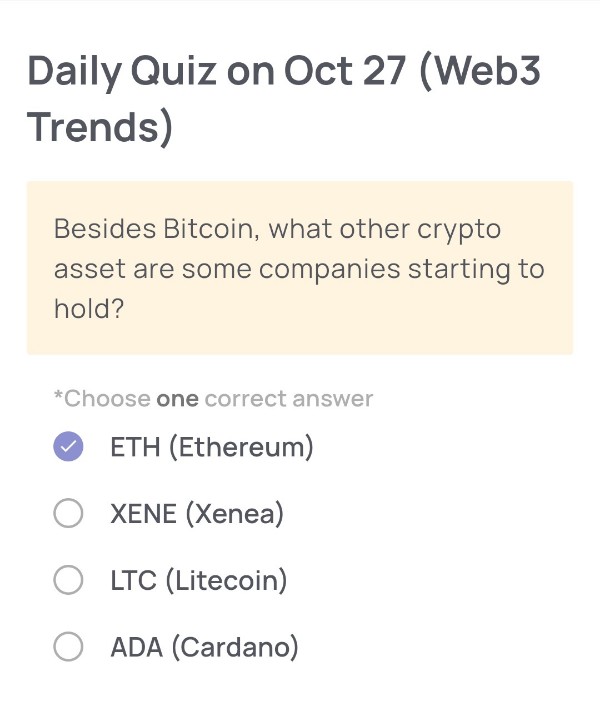

Daily Quiz on October 27

(Web3 Trends)

🟢Quiz Questions:

Besides Bitcoin, what other crypto asset are some companies starting to hold?

🟢Choose one correct answer:

・ETH (Ethereum)

・XENE (Xenea)

・LTC (Litecoin)

・ADA (Cardano)

🟢Answer:

ETH (Ethereum)

🟢Reason for choosing this answer:

Many companies and institutional investors are beginning to include Ethereum (ETH) in their balance sheets in addition to Bitcoin. This trend stems from Ethereum’s growing role as the foundational layer for decentralized finance (DeFi), NFTs, and Web3 applications. Its upcoming scaling upgrades (such as sharding and Layer 2 integration) also make ETH an attractive asset for long-term investment.

🟢Trivia:

Ethereum was launched in 2015 by Vitalik Buterin and is the first blockchain to introduce smart contracts — programmable agreements that automatically execute when conditions are met. This innovation transformed blockchain from a simple payment system (like Bitcoin) into a versatile platform for decentralized applications (dApps), giving rise to the modern Web3 ecosystem.

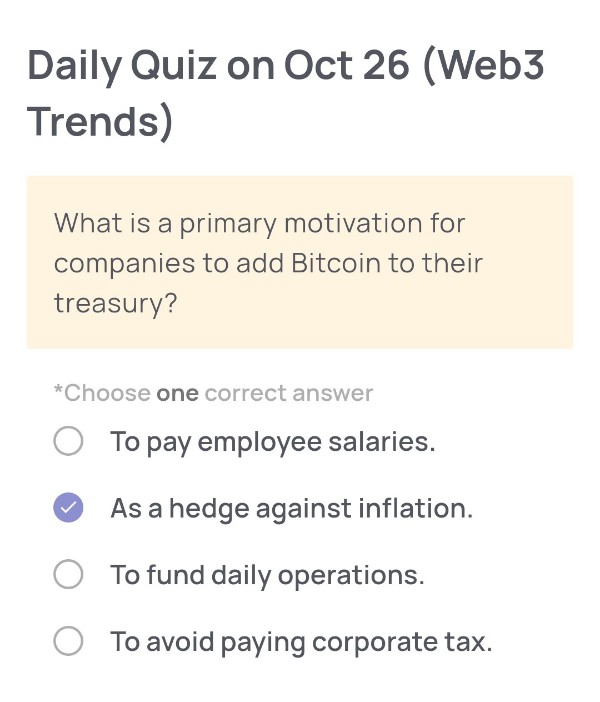

Daily Quiz on October 26

(Web3 Trends)

🟢Quiz Question::

What is a primary motivation for companies to add Bitcoin to their treasury?

🟢Choose one correct answer:

・To pay employee salaries.

・As a hedge against inflation.

・To fund daily operations.

・To avoid paying corporate tax.

🟢Answer:

As a hedge against inflation.

🟢Reason for choosing this answer:

Many companies add Bitcoin to their treasury as a way to protect their reserves from inflation and currency devaluation. Bitcoin’s limited supply of 21 million coins makes it a deflationary asset—unlike fiat currencies, which can be printed in unlimited quantities by central banks. By holding Bitcoin, corporations aim to preserve purchasing power over time and diversify away from traditional fiat-based assets.

🟢Trivia:

The trend of corporate Bitcoin adoption began gaining attention after MicroStrategy and Tesla added Bitcoin to their balance sheets in 2020–2021. MicroStrategy’s CEO, Michael Saylor, famously called Bitcoin “digital gold.” This move inspired many institutional investors to view Bitcoin as a long-term store of value, similar to how gold was historically used to hedge against inflation and economic uncertainty.

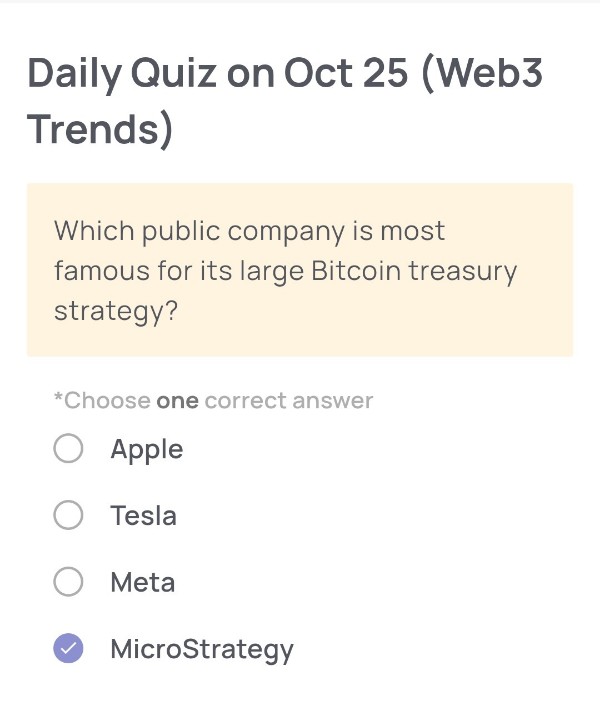

Daily Quiz on October 25

(Web3 Trends)

🟢Quiz Questions:

Which public company is most famous for its large Bitcoin treasury strategy?

🟢Choose one correct answer:

・Apple

・Tesla

・Meta

・MicroStrategy

🟢Answer:

MicroStrategy

🟢Reason for choosing this answer:

MicroStrategy is the public company best known for its aggressive Bitcoin accumulation strategy. Since 2020, the company—led by CEO Michael Saylor—has consistently purchased large amounts of Bitcoin as part of its corporate treasury strategy. MicroStrategy views Bitcoin as a superior store of value compared to cash, citing its scarcity and decentralized nature. As of 2025, MicroStrategy holds over 200,000 BTC, making it the largest corporate Bitcoin holder in the world.

🟢Trivia:

MicroStrategy’s bold Bitcoin strategy has influenced other institutional investors and corporations to consider Bitcoin as a treasury reserve asset. The company even introduced “Bitcoin bonds” and leveraged debt offerings to buy more Bitcoin. Michael Saylor himself has become one of the most recognized advocates of Bitcoin, often referring to it as “digital energy” or “the world’s first perfect money.”

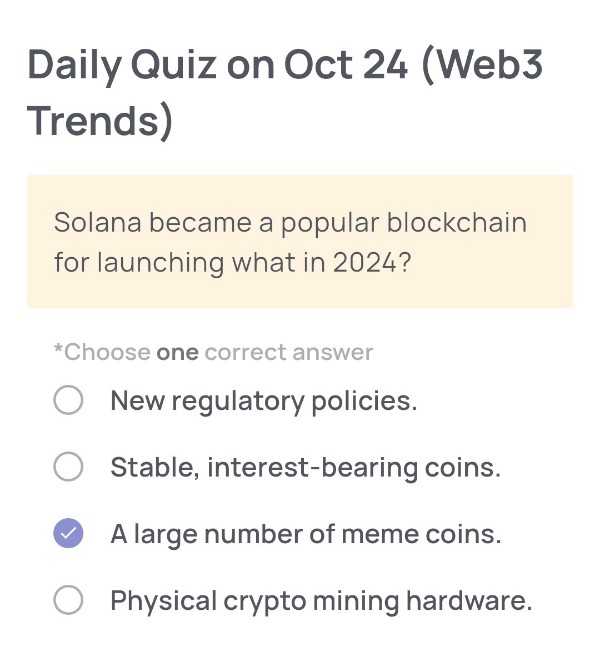

Daily Quiz on October 24

(Web3 Trends)

🟢Quiz Question:

Solana became a popular blockchain for launching what in 2024?

🟢Choose one correct answer:

・New regulatory policies.

・Stable, interest-bearing coins.

・A large number of meme coins.

・Physical crypto mining hardware.

🟢Answer:

A large number of meme coins.

🟢Reason for choosing this answer:

In 2024, Solana became a leading blockchain for launching and trading meme coins due to its high transaction speed and low fees. These characteristics made it especially popular among retail investors and developers looking to deploy tokens quickly. Projects like BONK and Dogwifhat (WIF) gained massive traction, driving Solana’s ecosystem activity and boosting on-chain volume.

🟢Trivia:

The surge of meme coins on Solana led to record-breaking daily transactions, sometimes exceeding Ethereum’s volume. This wave also attracted more developers to the Solana ecosystem, fostering the growth of decentralized exchanges (DEXs) like Jupiter and Raydium. Interestingly, the “meme coin season” on Solana helped revive the network’s reputation after its prior outages, marking 2024 as a comeback year for the blockchain.

Daily Quiz on October 23

(Web3 Trends)

🟢Quiz Question:

What service do Al projects like Fetch.ai (FET) provide?

🟢Choose one correct answer:

・Decentralized Al agents.

・Meme creation tutorials.

・Real estate management.

・Secure email services.

🟢Answer:

Decentralized Al agents.

🟢Reason for choosing this answer:

Fetch.ai (FET) focuses on creating a decentralized network of autonomous AI agents that can perform tasks such as data sharing, prediction, and process automation without relying on centralized control. These AI agents operate independently and can communicate, negotiate, and make decisions within a decentralized infrastructure, making services like logistics optimization, data marketplace management, and IoT coordination more efficient.

🟢Trivia:

Fetch.ai was founded in 2017 and uses blockchain technology to power its AI-based autonomous economic agents (AEAs). The project enables machine-to-machine communication where devices can perform transactions and exchange data autonomously. This model is seen as a cornerstone of the future “machine economy,” combining artificial intelligence, the Internet of Things (IoT), and blockchain.

Daily Quiz on October 22

(Web3 Trends)

🟢Quiz Question:

A key challenge for the RWA sector in 2025 is developing clear what?

🟢Choose one correct answer:

・Brand mascots and logos.

・Video game integrations.

・Regulatory frameworks.

・Social media channels.

🟢Answer:

Regulatory frameworks.

🟢Reason for choosing this answer:

In 2025, the Real World Asset (RWA) sector faces the crucial challenge of building clear regulatory frameworks to govern tokenization of assets such as real estate, bonds, and commodities. As RWA tokenization bridges traditional finance (TradFi) and blockchain, consistent global regulation is essential to ensure legal recognition, investor protection, and interoperability among jurisdictions. Without clear frameworks, institutional adoption and large-scale tokenization efforts remain limited.

🟢Trivia:

According to the 2023 Xenea Blog, the RWA tokenization market is projected to reach $4–16 trillion by 2030, but progress depends heavily on evolving legal clarity and compliance structures. Countries like Singapore, Switzerland, and the UAE are emerging as leaders in developing such regulatory environments for tokenized assets, while others are still catching up.

Daily Quiz on October 21

(Web3 Trends)

🟢Quiz Question:

The success of a meme coin is often highly dependent on what?

🟢Choose one correct answer:

・Government endorsement.

・A very complex whitepaper.

・Strong community engagement.

・A high initial token price.

🟢Answer:

Strong community engagement.

🟢Reason for choosing this answer:

The success of a meme coin usually depends on the strength and enthusiasm of its community rather than its technical foundation or institutional backing. A passionate community drives social media engagement, creates viral marketing, and fosters a sense of belonging—all of which contribute to the coin’s popularity and demand.

🟢Trivia:

Famous meme coins like Dogecoin and Shiba Inu owe much of their value and recognition to strong online communities. Elon Musk’s tweets, Reddit forums, and viral memes helped Dogecoin reach market capitalizations in the billions, showing that in Web3, community sentiment can often outweigh traditional financial metrics.

Daily Quiz on October 20

(Web3 Trends)

🟢Quiz Question:

Major financial institutions like BlackRock are exploring which area?

🟢Choose one correct answer:

・Creating their own meme coins.

・Al-powered customer chatbots.

・Shutting down crypto services.

・Tokenization of financial assets.

🟢Answer:

Tokenization of financial assets.

🟢Reason for choosing this answer:

Major financial institutions such as BlackRock, JPMorgan, and Franklin Templeton are actively exploring asset tokenization, which refers to converting traditional financial assets (like bonds, real estate, or funds) into digital tokens on the blockchain. This innovation improves transparency, liquidity, and settlement speed while reducing costs. BlackRock’s CEO Larry Fink has repeatedly highlighted tokenization as the “next generation for markets.”

🟢Trivia:

Asset tokenization is expected to become a multi-trillion-dollar market by 2030. For example, a 2023 report by the Boston Consulting Group estimated that the tokenization of real-world assets could reach $16 trillion by 2030 — a projection also referenced in the Xenea Whitepaper. Tokenization allows fractional ownership of assets like real estate or art, enabling broader access to investments that were previously illiquid or exclusive.

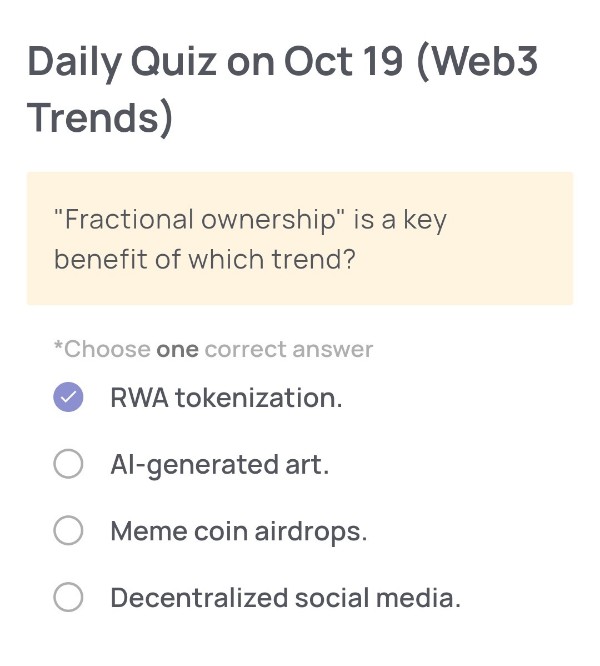

Daily Quiz on October 19

(Web3 Trends)

🟢Quiz Question:

“Fractional ownership” is a key benefit of which trend?

🟢Choose one correct answer:

・RWA tokenization.

・Al-generated art.

・Meme coin airdrops.

・Decentralized social media.

🟢Answer:

RWA tokenization.

🟢Reason for choosing this answer:

“Fractional ownership” means dividing ownership of a high-value real-world asset (like real estate, art, or commodities) into smaller, tradable portions. This is a core feature of RWA (Real World Asset) tokenization, which allows investors to buy fractional shares of real assets using blockchain-based tokens. By tokenizing assets, it increases liquidity, accessibility, and inclusiveness in traditionally illiquid markets.

🟢Trivia:

According to the Boston Consulting Group, the RWA tokenization market is projected to reach $4–16 trillion by 2030. A classic example is dividing a $100 million painting into 100,000 tokens, allowing many investors to own a $1,000 share each. This democratizes investment opportunities, making assets like fine art, real estate, and carbon credits accessible to a global audience through blockchain.

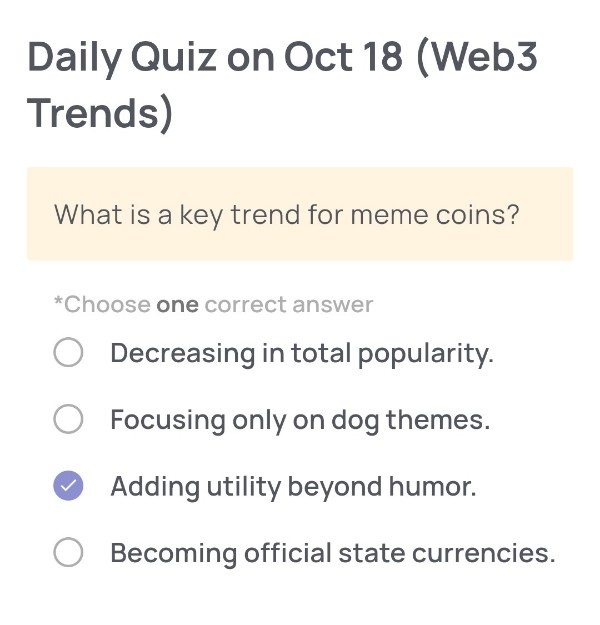

Daily Quiz on October 18

(Web3 Trends)

🟢Quiz Question:

What is a key trend for meme coins?

🟢Choose one correct answer:

・Decreasing in total popularity.

・Focusing only on dog themes.

・Adding utility beyond humor.

・Becoming official state currencies.

🟢Answer:

Adding utility beyond humor.

🟢Reason for choosing this answer:

Meme coins, originally popular for their humor and community-driven nature, are now evolving to include practical use cases such as staking, payments, and integration into broader ecosystems. Projects like $PEPE and $DOGE are exploring real-world applications or utility tokens to sustain long-term value rather than relying solely on hype. This marks a shift from pure speculation to function-based ecosystems in the meme coin sector.

🟢Trivia:

The first major meme coin, Dogecoin (DOGE), was created in 2013 as a joke inspired by the “Doge” meme. Despite its humorous origin, it has been used for charity donations, crowdfunding (including a NASCAR sponsorship), and micro-transactions. Today, many meme coins aim to follow a similar path by developing DeFi integrations, NFT utilities, and even governance roles within Web3 communities.

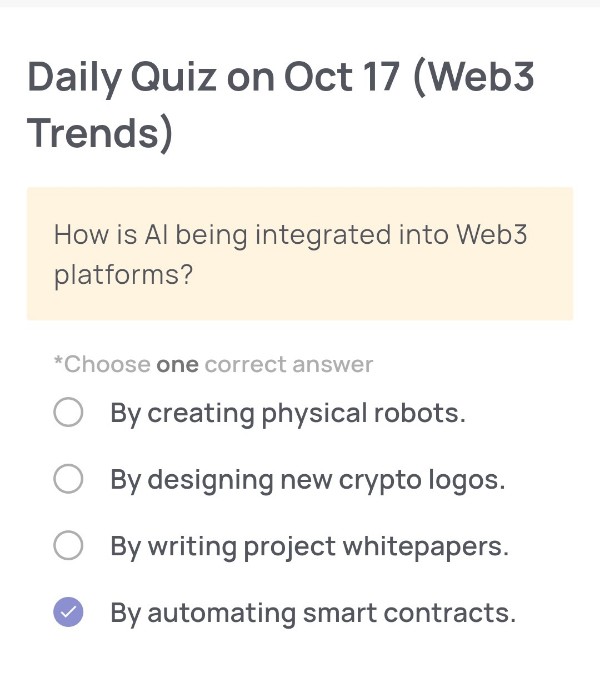

Daily Quiz on October 17

(Web3 Trends)

🟢Quiz Question:

How is Al being integrated into Web3 platforms?

🟢Choose one correct answer:

・By creating physical robots.

・By designing new crypto logos.

・By writing project whitepapers.

・By automating smart contracts..

🟢Answer:

By automating smart contracts.

🟢Reason for choosing this answer:

AI (Artificial Intelligence) is being integrated into Web3 platforms primarily to automate smart contracts and enhance blockchain operations. This means AI systems can analyze data, detect anomalies, and trigger contract execution automatically when specific conditions are met — all without manual input. This integration makes decentralized systems more efficient, adaptive, and scalable.

🟢Trivia:

AI-driven automation in Web3 is revolutionizing how decentralized applications (dApps) function. For instance, AI can monitor DeFi protocols to identify and execute optimal trading strategies in real time or detect suspicious activities to prevent fraud. Projects like Fetch.ai and SingularityNET are pioneers in merging AI with blockchain, paving the way for intelligent decentralized ecosystems where contracts can “think” and “act” autonomously.

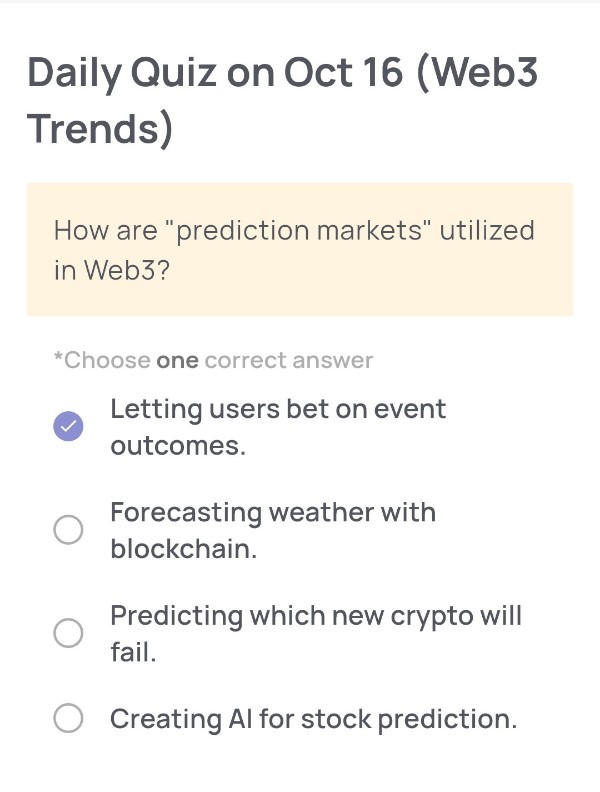

Daily Quiz on October 16

(Web3 Trends)

🟢Quiz Question:

How are “prediction markets” utilized in Web3?

🟢Choose one correct answer:

・Letting users bet on event outcomes.

・Forecasting weather with blockchain.

・Predicting which new crypto will fail.

・Creating AI for stock prediction.

🟢Answer:

Letting users bet on event outcomes.

🟢Reason for choosing this answer:

In Web3, prediction markets are decentralized platforms where users can buy and sell shares representing potential outcomes of future events. These could include elections, sports games, or crypto price movements. The market prices reflect the crowd’s aggregated beliefs or “predictions” about how likely each outcome is. Essentially, users are “betting” on what they believe will happen, and the blockchain ensures transparency, immutability, and decentralized settlement.

🟢Trivia:

One of the most well-known decentralized prediction market platforms is Augur, launched on the Ethereum blockchain. It allows anyone to create a market about almost any event. Another example is Polymarket, which has gained traction for its accuracy in forecasting real-world outcomes. Interestingly, researchers have found that blockchain-based prediction markets often produce more accurate forecasts than traditional polls, because participants have financial incentives to be correct.

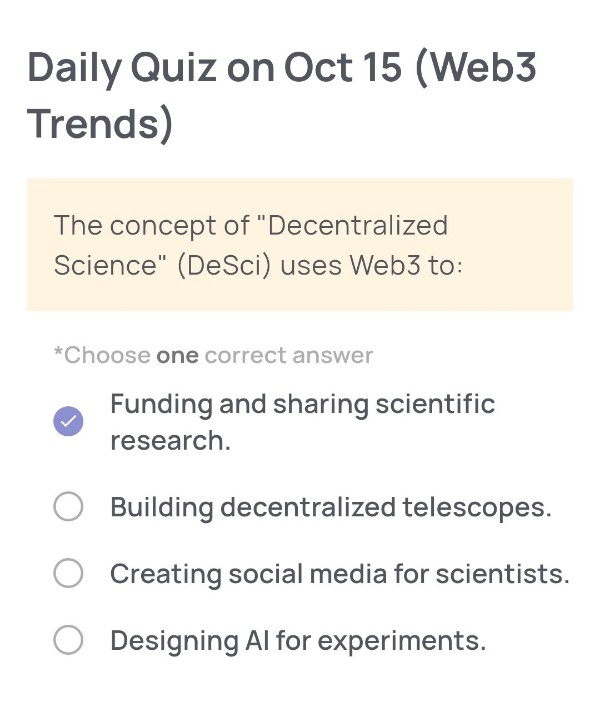

Daily Quiz on October 15

(Web3 Trends)

🟢Quiz Question:

The concept of “Decentralized Science” (DeSci) uses Web3 to:

🟢Choose one correct answer:

・Funding and sharing scientific research.

・Building decentralized telescopes.

・Creating social media for scientists.

・Designing Al for experiments.

🟢Answer:

Funding and sharing scientific research.

🟢Reason for choosing this answer:

Decentralized Science (DeSci) leverages blockchain and Web3 tools to make scientific research more transparent, collaborative, and independent from centralized institutions. By using decentralized funding models (like DAOs) and token-based incentives, researchers can raise funds directly from the community, publish results openly on-chain, and ensure that data and discoveries remain accessible to everyone.

🟢Trivia:

The DeSci movement began gaining traction around 2021 as part of a broader “Web3 for good” trend. Projects like VitaDAO and MoleculeDAO exemplify this idea—funding longevity and biomedical research through tokenized community governance. By eliminating intermediaries such as traditional publishers or grant bodies, DeSci aims to democratize scientific innovation and accelerate discovery worldwide.

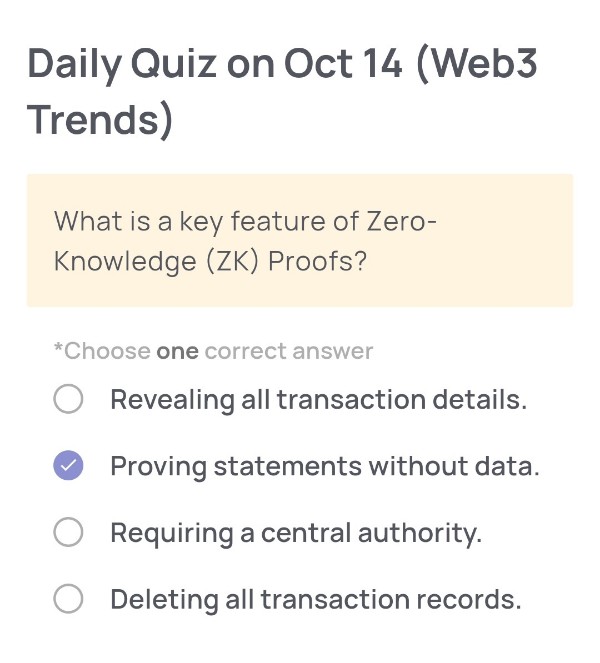

Daily Quiz on October 14

(Web3 Trends)

🟢Quiz Question:

What is a key feature of Zero-Knowledge (ZK) Proofs?

🟢Choose one correct answer:

・Revealing all transaction details.

・Proving statements without data.

・Requiring a central authority.

・Deleting all transaction records.

🟢Answer:

Proving statements without data.

🟢Reason for choosing this answer:

Zero-Knowledge (ZK) Proofs allow one party (the prover) to demonstrate to another party (the verifier) that a statement is true without revealing any underlying information or data that makes the statement true. This cryptographic method ensures privacy and security in blockchain systems by verifying transactions or identities without exposing sensitive details.

🟢Trivia:

ZK Proofs are a foundational technology behind ZK-Rollups, a popular Layer 2 scaling solution for blockchains like Ethereum. ZK-Rollups bundle multiple transactions off-chain and then submit a single proof on-chain, significantly reducing gas fees and increasing transaction throughput while maintaining strong privacy and security.

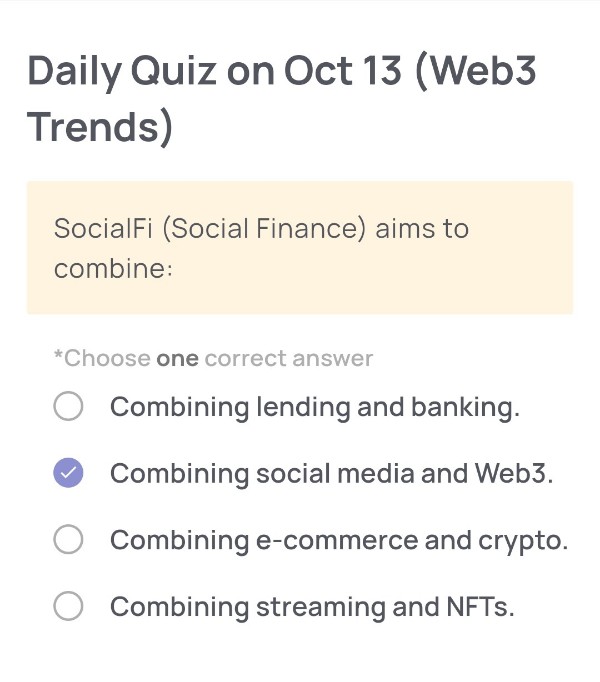

Daily Quiz on October 13

(Web3 Trends)

🟢Quiz Questions:

SocialFi (Social Finance) aims to combine:

🟢Choose one correct answer:

・Combining lending and banking.

・Combining social media and Web3.

・Combining e-commerce and crypto.

・Combining streaming and NFTs.

🟢Answer:

Combining social media and Web3.

🟢Reason for choosing this answer:

SocialFi, short for “Social Finance,” merges the features of social media with Web3’s decentralized finance (DeFi) principles. It allows users to monetize their content, reputation, and social interactions using blockchain technology. In SocialFi platforms, users own their data and can earn tokens through activities such as posting, engaging with others, or building communities—unlike traditional social networks where profits are centralized.

🟢Trivia:

A leading example of SocialFi is Friend.tech, which runs on Base (a Layer 2 network). Users can buy and sell “shares” or “keys” of social profiles, giving access to exclusive chats or content. This model represents how SocialFi is redefining the creator economy—turning social influence and community engagement into on-chain assets and income streams.

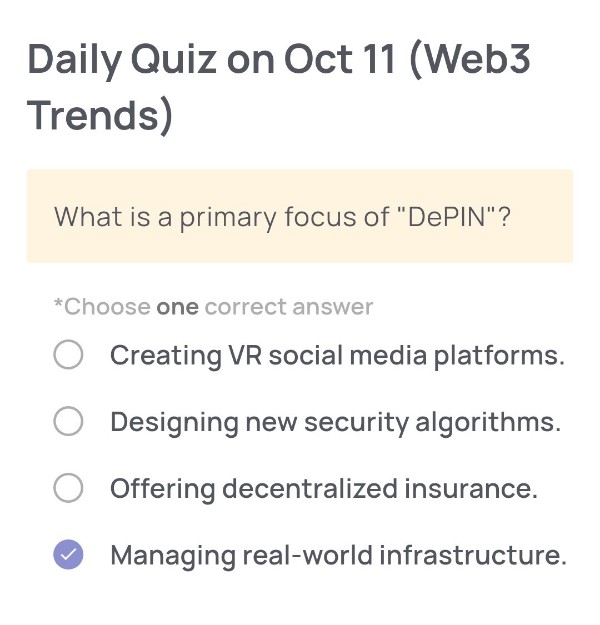

Daily Quiz on October 11

(Web3 Trends)

🟢Quiz Question:

What is a primary focus of “DePIN”?

🟢Choose one correct answer:

・Creating VR social media platforms.

・Designing new security algorithms.

・Offering decentralized insurance.

・Managing real-world infrastructure.

🟢Answer:

Managing real-world infrastructure.

🟢Reason for choosing this answer:

“DePIN” stands for Decentralized Physical Infrastructure Networks. Its main goal is to use blockchain and token incentives to build, operate, and maintain real-world infrastructure—such as wireless networks, storage, or energy grids—in a decentralized way. Instead of relying on centralized corporations, DePIN enables individuals and communities to contribute resources and get rewarded, making infrastructure more efficient and community-driven.

🟢Trivia:

Projects like Helium (for wireless networks) and Filecoin (for decentralized storage) are well-known examples of DePIN. This emerging sector bridges the gap between the digital blockchain world and tangible physical assets, allowing users to earn crypto rewards by providing real-world services such as connectivity, data storage, or energy distribution.

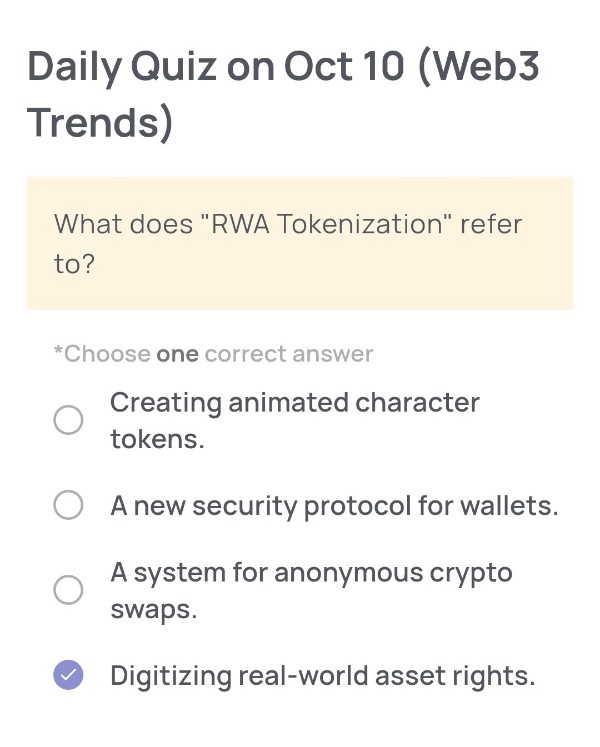

Daily Quiz on October 10

(Web3 Trends)

🟢Quiz Question:

What does “RWA Tokenization” refer to?

🟢Choose one correct answer:

・Creating animated character tokens.

・A new security protocol for wallets.

・A system for anonymous crypto swaps.

・Digitizing real-world asset rights.

🟢Answer:

Digitizing real-world asset rights.

🟢Reason for choosing this answer:

“RWA Tokenization” stands for Real World Asset Tokenization, which means converting the ownership or rights of real-world assets—such as real estate, gold, artwork, or stocks—into digital tokens on a blockchain. This allows these assets to be traded more efficiently and transparently in digital markets while maintaining verifiable ownership records.

🟢Trivia:

According to Boston Consulting Group, the RWA tokenization market is expected to reach between $4 trillion and $16 trillion by 2030. Platforms like Xenea are at the forefront of this movement, integrating decentralized storage (DACS) and Proof of Democracy (PoD) consensus to ensure data integrity and long-term asset traceability.

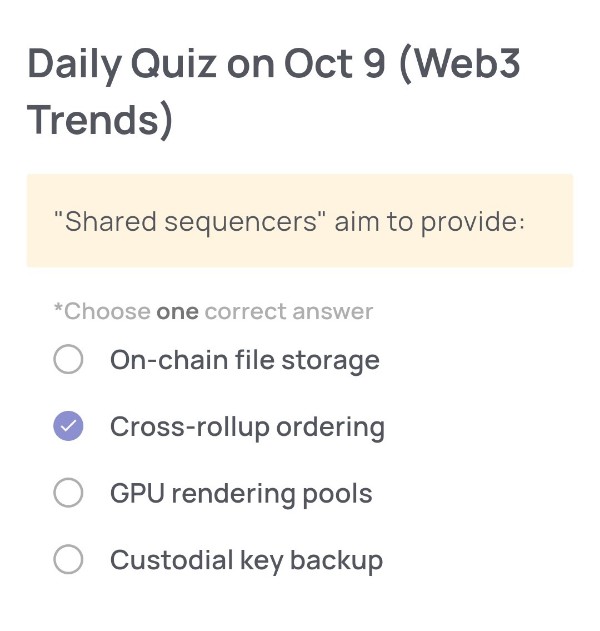

Daily Quiz on October 9

(Web3 Trends)

🟢Quiz Question:

“Shared sequencers” aim to provide:

🟢Choose one correct answer:

・On-chain file storage

・Cross-rollup ordering

・GPU rendering pools

・Custodial key backup

🟢Answer:

Cross-rollup ordering

🟢Reason for choosing this answer:

Shared sequencers are a new approach in modular blockchain design, primarily developed to coordinate transaction ordering across multiple rollups. Instead of each rollup maintaining its own sequencer, a shared sequencer provides a unified layer that ensures fair ordering and interoperability between them. This helps prevent issues like front-running and improves cross-rollup atomicity, enhancing user experience and system integrity in multi-rollup ecosystems.

🟢Trivia:

Projects like Astria, Espresso Systems, and Radius are leading in developing shared sequencer infrastructure. These systems aim to create a decentralized market for sequencing, enabling better interoperability among Layer 2s such as Optimism, Arbitrum, and Base—a crucial step toward achieving a truly modular and interconnected Web3 ecosystem.

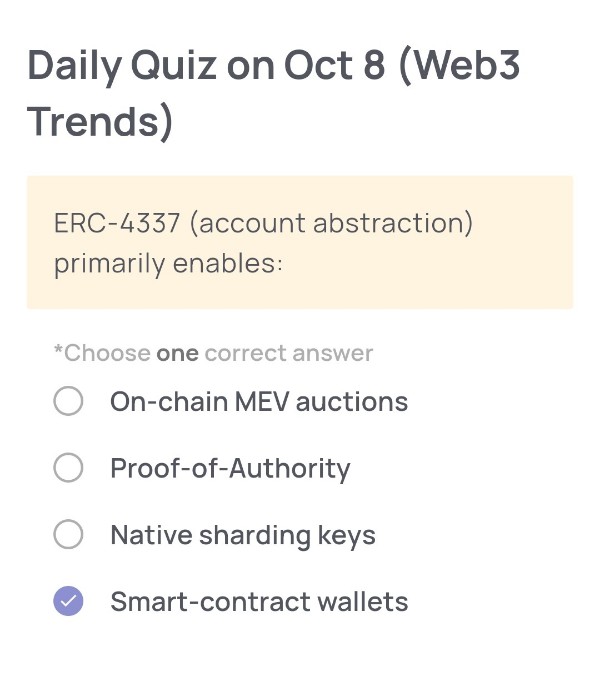

Daily Quiz on October 8

(Web3 Trends)

🟢Quiz Question:

ERC-4337 (account abstraction) primarily enables:

🟢Choose one correct answer:

・On-chain MEV auctions

・Proof-of-Authority

・Native sharding keys

・Smart-contract wallets

🟢Answer:

Smart-contract wallets

🟢Reason for choosing this answer:

ERC-4337 introduces account abstraction to Ethereum, allowing users to manage their accounts through smart contracts rather than traditional externally owned accounts (EOAs) that rely solely on private keys.

This standard defines how user operations are handled by a new entity called the “EntryPoint” contract, which processes user transactions. It enables features like multi-signature security, social recovery, and customizable transaction logic — all through smart-contract-based wallets without changing Ethereum’s core protocol.

🟢Trivia:

ERC-4337 was officially deployed on Ethereum mainnet in March 2023. It was designed to improve wallet usability and security by allowing gas sponsorship (others can pay gas fees on behalf of users), biometric logins, and automated transaction management — paving the way for a more user-friendly Web3 experience without compromising decentralization.

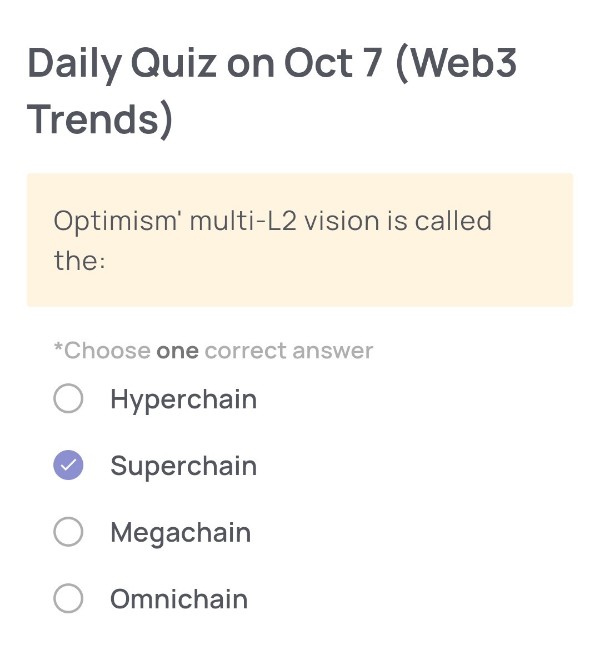

Daily Quiz on October 7

(Web3 Trends)

🟢Quiz Question:

Optimism’ multi-L2 vision is called the:

🟢Choose one correct answer:

・Hyperchain

・Superchain

・Megachain

・Omnichain

🟢Answer:

Superchain

🟢Reason for choosing this answer:

Optimism, the Layer 2 scaling solution for Ethereum, introduced the concept of the Superchain — a network of interoperable Layer 2 chains built using the OP Stack. The goal is to create a unified ecosystem where multiple L2s share security, communication standards, and governance, making them function like parts of a single blockchain.

🟢Trivia:

The Superchain vision aims to make Ethereum scaling modular and collaborative. Coinbase’s Layer 2, Base, is one of the most well-known projects built with the OP Stack and is part of the Superchain. This concept promotes the idea of a shared, open-source infrastructure where different chains can work together seamlessly, much like how the Internet connects different networks into one cohesive system.

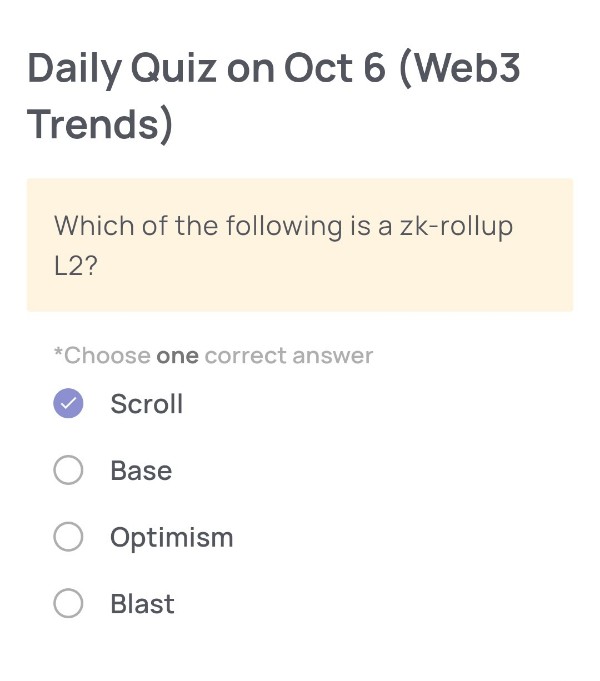

Daily Quiz on October 6

(Web3 Trends)

🟢Quiz Questions:

Which of the following is a zk-rollup L2?

🟢Choose one correct answer:

・Scroll

・Base

・Optimism

・Blast

🟢Answer:

Scroll

🟢Reason for choosing this answer:

Scroll is a zk-rollup Layer 2 solution built on Ethereum. It uses zero-knowledge proofs (zk-proofs) to batch and verify transactions off-chain before submitting them to Ethereum, ensuring both scalability and strong security guarantees. In contrast, Base and Optimism are Optimistic Rollups, and Blast is also Optimistic-based with a yield mechanism, not zk-based.

🟢Trivia:

The term “zk-rollup” refers to a scaling solution that leverages zero-knowledge cryptography to validate large batches of transactions efficiently. By proving the correctness of all transactions with a succinct cryptographic proof, zk-rollups reduce the load on Ethereum while maintaining the same level of security. Popular zk-rollup projects include zkSync, StarkNet, Polygon zkEVM, and Scroll, all of which represent a key evolution toward a more scalable Web3 ecosystem.

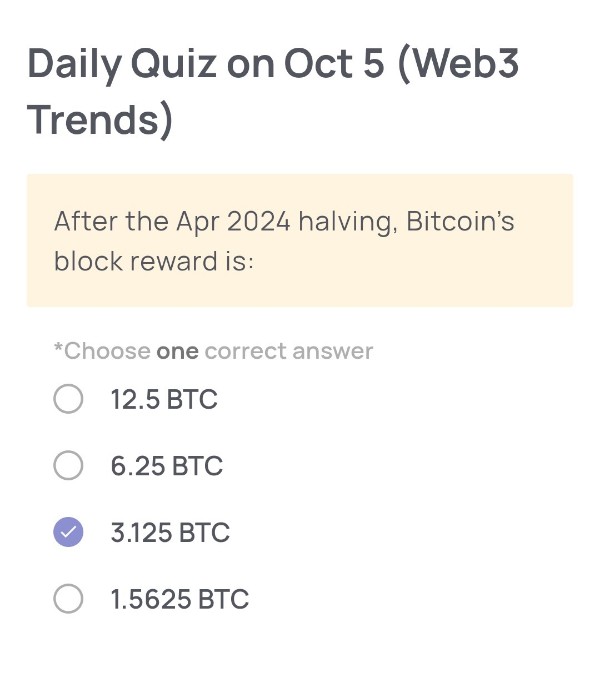

Daily Quiz on October 5

(Web3 Trends)

🟢Quiz Question:

After the Apr 2024 halving, Bitcoin’s block reward is:

🟢Choose one correct answer:

・12.5 BTC

・6.25 BTC

・3.125 BTC

・1.5625 BTC

🟢Answer:

3.125 BTC

🟢Reason for choosing this answer:

Bitcoin’s block reward halves approximately every four years. Before April 2024, the reward was 6.25 BTC per block. After the fourth halving event in April 2024, it was reduced by 50%, resulting in a new block reward of 3.125 BTC. This halving mechanism is built into Bitcoin’s code to control inflation and ensure scarcity over time.

🟢Trivia:

Bitcoin started with a 50 BTC block reward when it launched in 2009. Through successive halvings in 2012 (25 BTC), 2016 (12.5 BTC), 2020 (6.25 BTC), and 2024 (3.125 BTC), the issuance rate has steadily declined. The next halving, expected around 2028, will reduce the reward to 1.5625 BTC. This process will continue until approximately the year 2140, when the total Bitcoin supply reaches its cap of 21 million coins.

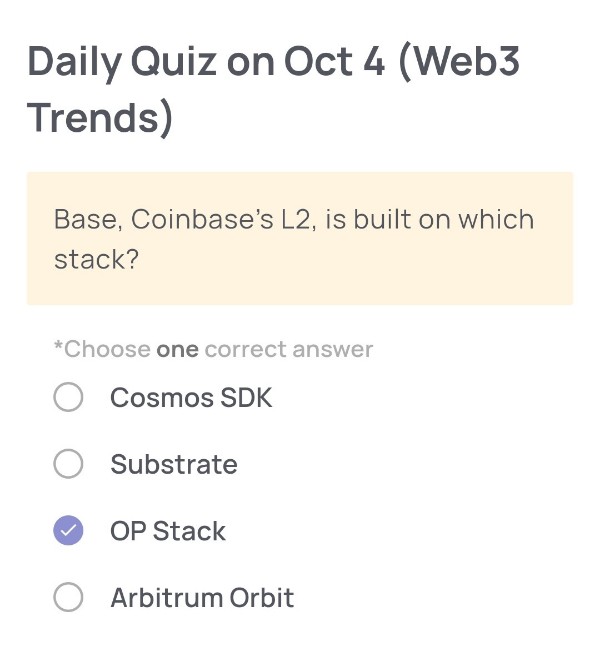

Daily Quiz on October 4

(Web3 Trends)

🟢Quiz Questions:

Base, Coinbase’s L2, is built on which stack?

🟢Choose one correct answer:

・Cosmos SDK

・Substrate

・OP Stack

・Arbitrum Orbit

🟢Answer:

OP Stack

🟢Reason for choosing this answer:

Base, developed by Coinbase, is an Ethereum Layer 2 network that uses the OP Stack framework, the same open-source rollup architecture powering Optimism. The OP Stack was chosen because it enables scalability, lower fees, and compatibility with Ethereum’s ecosystem while allowing modular upgrades in the future. This makes it easier for developers to deploy dApps without sacrificing security or decentralization.

🟢Trivia:

The OP Stack is designed to be a “public good” infrastructure, governed by the Optimism Collective. Interestingly, Base has pledged to return a portion of its transaction fees back to the Optimism Collective treasury to support the development of public goods in the Ethereum ecosystem. This creates a collaborative rather than competitive dynamic between Layer 2s built on the same stack.

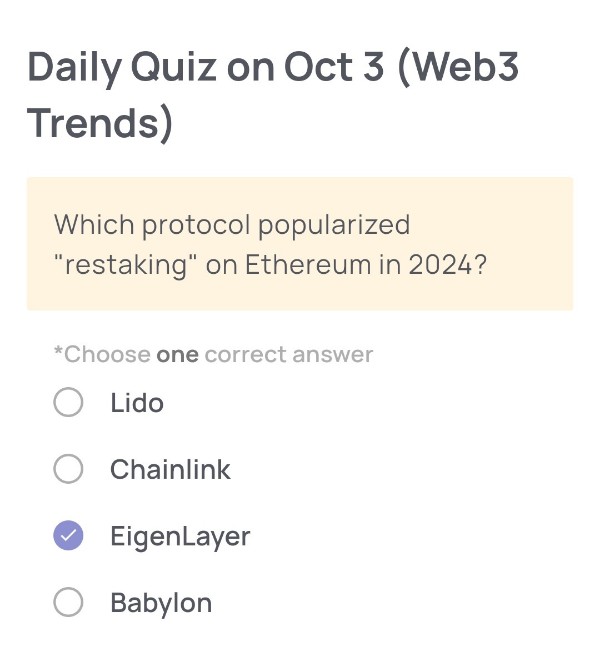

Daily Quiz on October 3

(Web3 Trends)

🟢Quiz Questions:

Which protocol popularized “restaking” on Ethereum in 2024?

🟢Choose one correct answer:

・Lido

・Chainlink

・EigenLayer

・Babylon

🟢Answer:

EigenLayer

🟢Reason for choosing this answer:

EigenLayer introduced and popularized the concept of “restaking” on Ethereum in 2024. Restaking allows users to take already staked ETH (or liquid staking tokens like stETH from Lido) and “restake” them to secure other protocols. This innovation created a shared security marketplace, enabling Ethereum’s validator set to extend its trust guarantees beyond the Ethereum base layer.

🟢Trivia:

The rise of EigenLayer sparked major discussions around Ethereum’s security model. While it unlocks powerful new opportunities for protocols to “borrow” Ethereum’s economic security, it also raised concerns about slashing risks and systemic contagion—since misbehavior in one protocol could jeopardize stakers across multiple services. By mid-2024, EigenLayer had become one of the most watched projects in Ethereum’s ecosystem, often referred to as a potential cornerstone of “Ethereum’s security economy.”

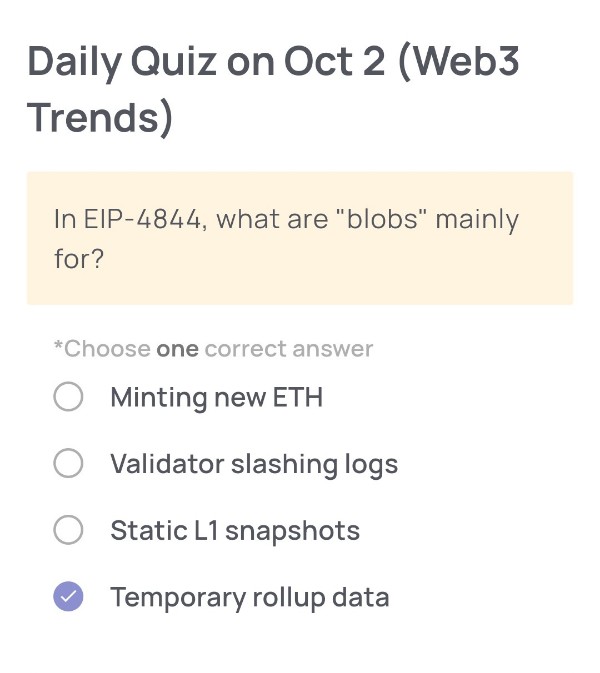

Daily Quiz on October 2

(Web3 Trends)

🟢Quiz Questions:

In EIP-4844, what are “blobs” mainly for?

🟢Choose one correct answer:

・Minting new ETH

・Validator slashing logs

・Static L1 snapshots

・Temporary rollup data

🟢Answer:

Temporary rollup data

🟢Reason for choosing this answer:

EIP-4844, also known as Proto-Danksharding, introduces “blobs” (large binary objects) as a way to handle temporary rollup data on Ethereum. These blobs are not permanently stored on-chain but instead exist for a limited time to reduce costs and improve scalability for Layer 2 rollups. This makes transactions much cheaper by offloading large amounts of data from Ethereum’s main storage while still maintaining security guarantees.

🟢Trivia:

Blobs in EIP-4844 are expected to cut rollup fees by 10x–100x, making Ethereum far more competitive with other blockchains in terms of transaction costs. They are a stepping stone toward full Danksharding, Ethereum’s long-term scalability solution. Interestingly, blobs are not directly accessible to the EVM (Ethereum Virtual Machine), which ensures they are used strictly for data availability and not as permanent storage.

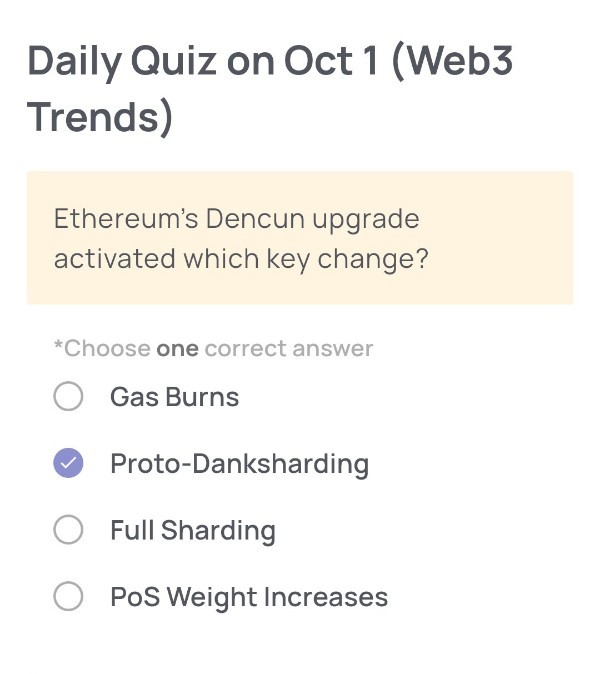

Daily Quiz on October 1

(Web3 Trends)

🟢Quiz Questions:

Ethereum’s Dencun upgrade activated which key change?

🟢Choose one correct answer:

・Gas Burns

・Proto-Danksharding

・Full Sharding

・PoS Weight Increases

🟢Answer:

Proto-Danksharding

🟢Reason for choosing this answer:

The Dencun upgrade (activated on Ethereum in March 2024) introduced Proto-Danksharding (EIP-4844). This upgrade enabled the use of “blobs” for storing large amounts of transaction data more cheaply off-chain while still being verified by Ethereum. It was designed to significantly reduce rollup costs, making Layer 2 transactions cheaper and more scalable. The other options (Gas Burns, Full Sharding, PoS Weight Increases) were not part of the Dencun upgrade.

🟢Trivia:

Proto-Danksharding is considered a stepping stone toward full Danksharding, Ethereum’s long-term scaling solution. While full sharding will involve splitting the blockchain into multiple shards, Proto-Danksharding introduces temporary data blobs without full shard chains. This innovation boosts Layer 2 scalability today and lays the groundwork for Ethereum to support millions of transactions per second in the future.

Comment