👉April Answers and Trivia

👉March Answers and Trivia

👉February Answers and Trivia

👉January Answers and Trivia

XENEA Wallet features a Daily Quiz that enhances user engagement while offering a fun and gamified way to learn about Web3 and the Xenea ecosystem.

Although many kind individuals are sharing answers on X (formerly Twitter), it feels like the quiz is turning into a game of simply picking the right answer without understanding the questions. To address this, this article will provide not only the answers to XENEA Wallet’s Daily Quiz but also the reasoning behind them and additional insights. By leveraging XENEA Wallet NAVI (ChatGPT), we aim to make the experience more informative and meaningful.

It takes less than a minute, so bookmark this page and check back daily! 😊

Start Your Journey with XENEA Wallet Today!

XENEA Wallet is an innovative app that makes exploring the world of Web3 both fun and rewarding! Complete simple missions, claim daily bonuses, and earn rewards while learning about the future of digital technology.

With cutting-edge security and unparalleled convenience, XENEA Wallet offers you the chance to participate in future airdrops and mining opportunities. Simply download the app to begin your new digital experience!

New users can start with 1,000 gems by signing up with the invite code below!

1️⃣ Download the app

2️⃣ Enter the invite code: h3dYzHejPI

3️⃣ Sign up with your Google or Apple account

Enjoy the exciting world of XENEA Wallet!

Please refer to the following page for information on how to earn Gems.

How many days does it take to earn 10,000 gems and start automatic mining with the XENEA Wallet?

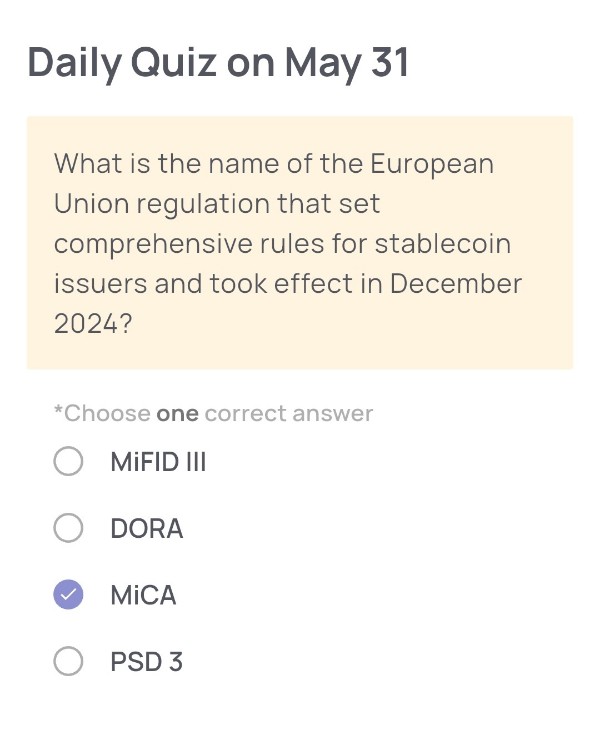

Daily Quiz on MAY 31

🟢 Quiz Questions:

What is the name of the European Union regulation that set comprehensive rules for stablecoin issuers and took effect in December 2024?

🟢 Choose one correct answer:

・MiFID III

・DORA

・MICA

・PSD 3

🟢 Answer:

MICA

🟢 Reason for choosing this answer:

The Markets in Crypto-Assets Regulation (MiCA) is the European Union’s comprehensive regulatory framework for crypto-assets, including stablecoins. MiCA aims to provide legal certainty, protect consumers, and ensure financial stability by establishing uniform rules across EU member states. The regulation became fully applicable on December 30, 2024, with specific provisions for stablecoin issuers effective from June 30, 2024 .

🟢 Trivia:

MiCA introduces a classification system for crypto-assets, distinguishing between asset-referenced tokens (ARTs), electronic money tokens (EMTs), and other crypto-assets. It sets out requirements for issuers and service providers, including obligations related to transparency, disclosure, authorization, and supervision. By harmonizing regulations across the EU, MiCA aims to foster innovation while safeguarding the financial system .

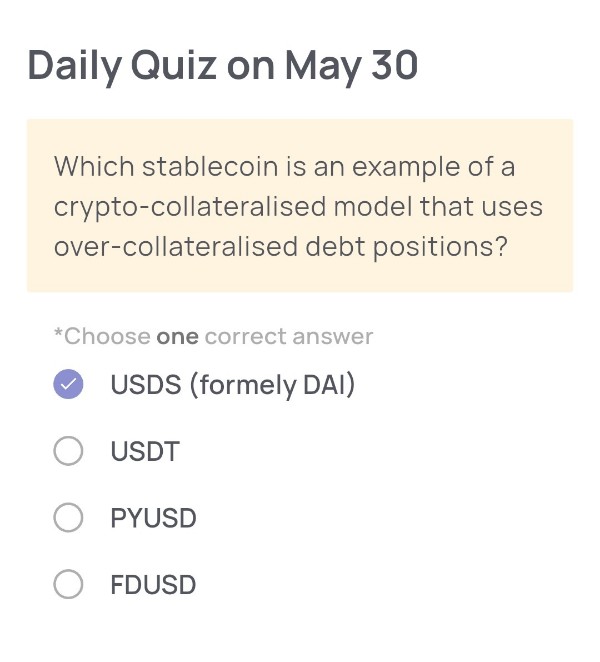

Daily Quiz on MAY 30

🟢Quiz Questions:

Which stablecoin is an example of a crypto-collateralised model that uses over-collateralised debt positions?

🟢Choose one correct answer:

・USDS (formely DAI)

・USDT

・PYUSD

・FDUSD

🟢Answer:

USDS (formely DAI)

🟢Reason for choosing this answer:

USDS, formerly known as DAI, is a stablecoin that operates on a crypto-collateralized model. It is issued through the MakerDAO protocol and backed by over-collateralized debt positions, typically involving assets like Ethereum and other approved cryptocurrencies. This model requires users to lock in more collateral than the value of DAI they receive, ensuring stability even with crypto market volatility.

🟢Trivia:

DAI was one of the first decentralized stablecoins, and its over-collateralization mechanism makes it distinct from centralized stablecoins like USDT (Tether), which are backed by fiat reserves. This design offers more transparency and decentralization, appealing to users seeking a trustless system.

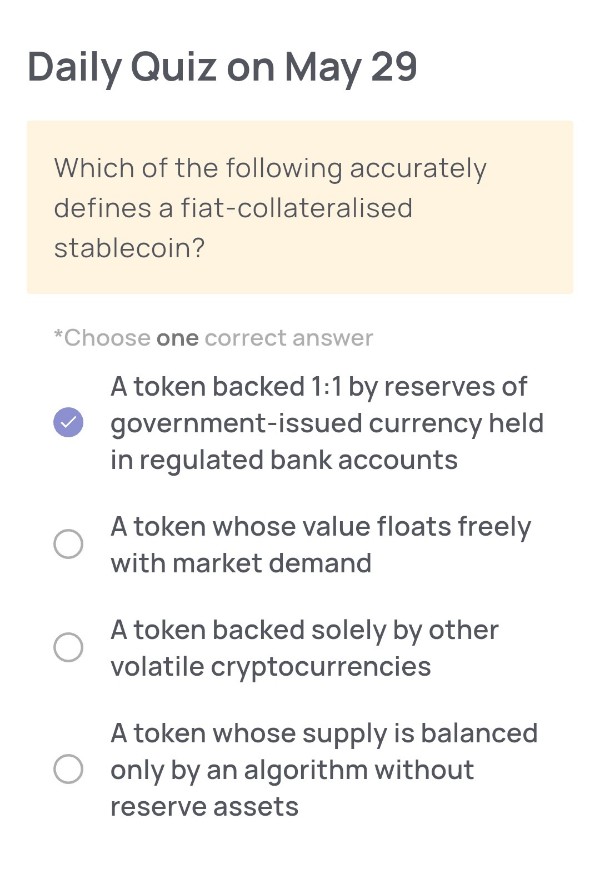

Daily Quiz on MAY 29

🟢Quiz Questions:

Which of the following accurately defines a fiat-collateralised stablecoin?

🟢Choose one correct answer:

・A token backed 1:1 by reserves of government-issued currency held in regulated bank accounts

・A token whose value floats freely with market demand

・A token backed solely by other volatile cryptocurrencies

・A token whose supply is balanced only by an algorithm without reserve assets

🟢Answer:

A token backed 1:1 by reserves of government-issued currency held in regulated bank accounts

🟢Reason for choosing this answer:

A fiat-collateralised stablecoin is designed to maintain a stable value by being fully backed by reserves of a fiat currency, such as USD or EUR. These reserves are held in regulated financial institutions, ensuring that each token issued can be redeemed for an equivalent amount of the fiat currency. This backing mechanism keeps the token price stable and directly pegged to the fiat currency it represents.

🟢Trivia:

One of the most well-known fiat-collateralised stablecoins is Tether (USDT), which claims to be backed 1:1 by U.S. dollar reserves. Other examples include USDC and BUSD. These stablecoins are widely used in cryptocurrency trading as a stable store of value and a medium of exchange.

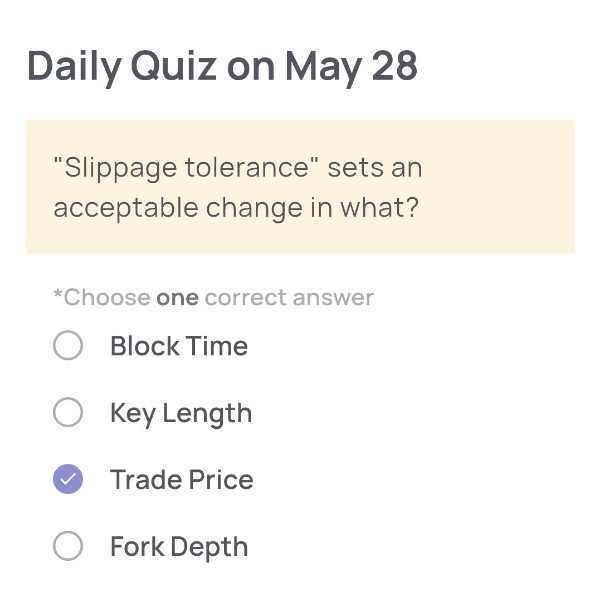

Daily Quiz on MAY 28

🟢Quiz Questions:

“Slippage tolerance” sets an acceptable change in what?

🟢Choose one correct answer:

・Block Time

・Key Length

・Trade Price

・Fork Depth

🟢Answer:

Trade Price

🟢Reason for choosing this answer:

“Slippage tolerance” is a term commonly used in cryptocurrency and DeFi trading. It refers to the acceptable percentage difference between the expected price of a trade and the actual price at which the trade is executed. This setting helps traders manage the risk of price changes caused by market volatility or low liquidity during the execution of a transaction.

🟢Trivia:

On decentralized exchanges (DEXs) like Uniswap or PancakeSwap, slippage is a common issue due to the automated market maker (AMM) model. If the slippage tolerance is set too low, the trade may fail. If it’s set too high, traders might end up overpaying significantly, especially during high volatility or for low liquidity tokens.

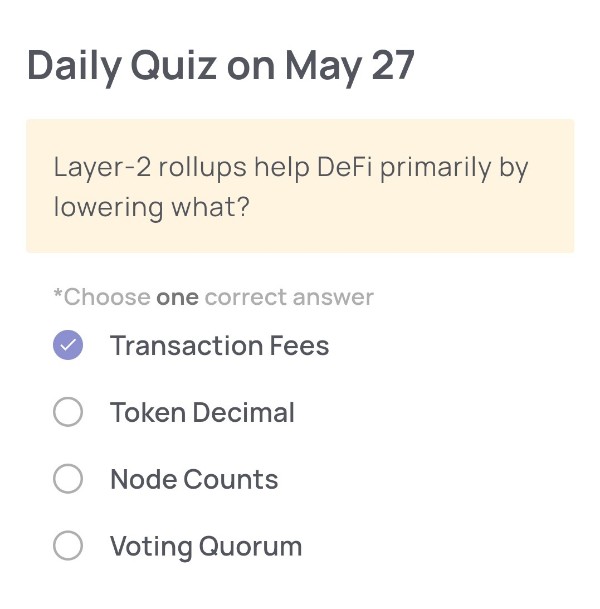

Daily Quiz on MAY 27

🟢Quiz Questions:

Layer-2 rollups help DeFi primarily by lowering what?

🟢Choose one correct answer:

・Transaction Fees

・Token Decimal

・Node Counts

・Voting Quorum

🟢Answer:

Transaction Fees

🟢 Reason for choosing this answer:

Layer-2 rollups are designed to process transactions off the main Ethereum chain (Layer-1), aggregating many transactions into a single batch before posting back to Layer-1. This dramatically reduces the amount of data each individual transaction uses on the Ethereum blockchain, which in turn significantly lowers the gas fees users must pay. This cost-efficiency makes decentralized finance (DeFi) more accessible and scalable.

🟢 Trivia:

One popular type of Layer-2 rollup is the “zk-Rollup,” which uses zero-knowledge proofs to verify batches of transactions. Another type is the “Optimistic Rollup,” which assumes transactions are valid and only runs fraud proofs if challenged. Both aim to improve Ethereum’s scalability and user experience.

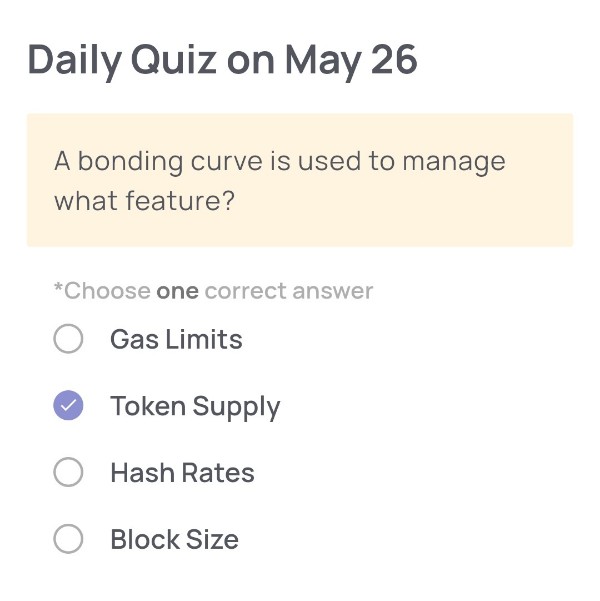

Daily Quiz on MAY 26

🟢Quiz Questions:

A bonding curve is used to manage what feature?

🟢Choose one correct answer:

・Gas Limits

・Token Supply

・Hash Rates

・Block Size

🟢Answer:

Token Supply

🟢Reason for choosing this answer:

A bonding curve is a mathematical curve that defines the relationship between the price and supply of a token. It is often used in decentralized finance (DeFi) and token economies to automatically adjust the token price based on demand and supply. When more tokens are bought, the price increases along the curve; when tokens are sold, the price decreases. This helps manage token issuance and ensures a dynamic, market-driven valuation.

🟢Trivia:

Bonding curves are especially popular in Initial DEX Offerings (IDOs) and NFT platforms, enabling automated market making and fundraising without needing traditional order books or centralized intermediaries. They can help bootstrap liquidity and incentivize early participation by pricing early tokens lower on the curve.

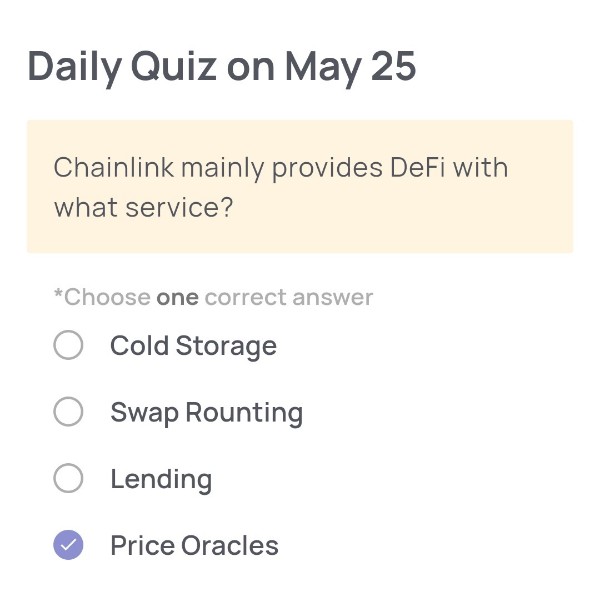

Daily Quiz on MAY 25

🟢Quiz Questions:

Chainlink mainly provides DeFi with what service?

🟢Choose one correct answer:

・Cold Storage

・Swap Rounting

・Lending

・Price Oracles

🟢Answer:

Price Oracles

🟢Reason for choosing this answer:

Chainlink is widely known for its decentralized oracle network that supplies smart contracts with real-world data, particularly price feeds. This is essential for DeFi applications to function reliably, as smart contracts need accurate external data (like asset prices) to execute transactions correctly. Thus, among the choices provided, “Price Oracles” best describes Chainlink’s primary role in the DeFi ecosystem.

🟢Trivia:

Chainlink’s decentralized oracles are used by major DeFi platforms such as Aave, Synthetix, and Compound. The network enhances security by aggregating data from multiple sources and using cryptographic proofs, helping prevent exploits caused by faulty or manipulated data feeds.

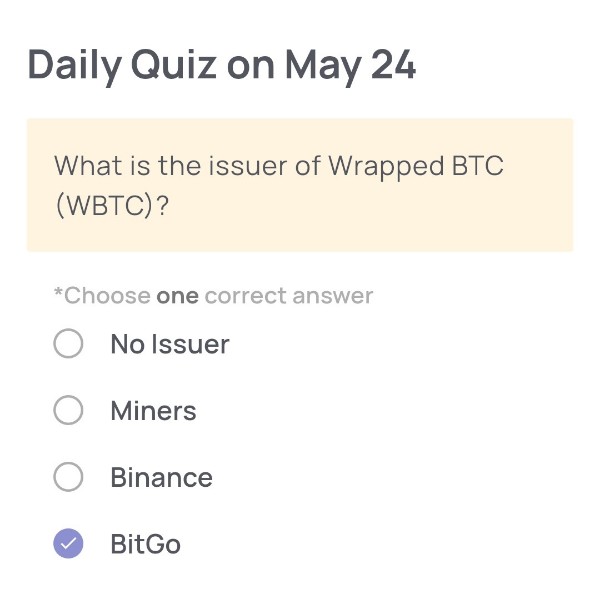

Daily Quiz on MAY 24

🟢Quiz Questions:

What is the issuer of Wrapped BTC (WBTC)?

🟢Choose one correct answer:

・No Issuer

・Miners

・Binance

・BitGo

🟢Answer:

BitGo

🟢Reason for choosing this answer:

Wrapped BTC (WBTC) is a tokenized version of Bitcoin that exists on the Ethereum blockchain. It is issued and maintained by BitGo, which acts as the custodian. BitGo holds the actual BTC in reserve and issues the equivalent amount of WBTC on Ethereum, ensuring that every WBTC is backed 1:1 with real Bitcoin.

🟢Trivia:

WBTC allows Bitcoin holders to participate in the Ethereum ecosystem, including DeFi applications, without selling their BTC. BitGo collaborates with merchants and custodians to manage the minting and burning process, and all reserves are transparently auditable on-chain.

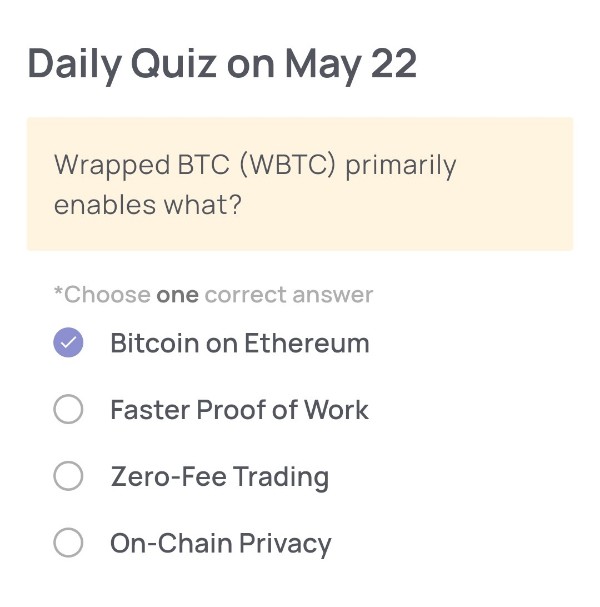

Daily Quiz on MAY 22

🟢Quiz Questions:

Wrapped BTC (WBTC) primarily enables what?

🟢Choose one correct answer:

・Bitcoin on Ethereum

・Faster Proof of Work

・Zero-Fee Trading

・On-Chain Privacy

🟢Answer:

Bitcoin on Ethereum

🟢Reason for choosing this answer:

Wrapped BTC (WBTC) is a tokenized version of Bitcoin that runs on the Ethereum blockchain. It is pegged 1:1 to Bitcoin and allows users to interact with decentralized applications (dApps) on Ethereum using Bitcoin’s value. This interoperability bridges the gap between the Bitcoin and Ethereum ecosystems, enabling Bitcoin holders to participate in DeFi services such as lending, trading, and liquidity provision on Ethereum.

🟢Trivia:

WBTC is governed by a decentralized autonomous organization (DAO) called the WBTC DAO, composed of numerous projects in the DeFi space. The Bitcoin backing each WBTC is held by custodians, and its creation or burning is handled by merchants who interact with users. This system ensures that each WBTC token is verifiably backed by actual BTC reserves.

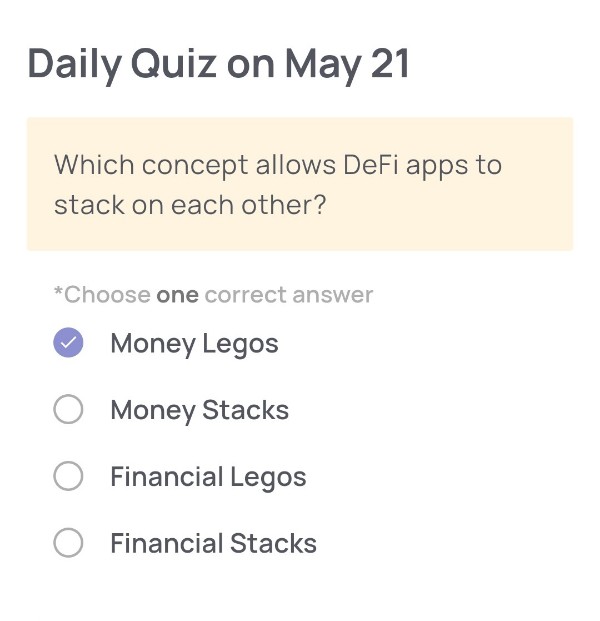

Daily Quiz on MAY 21

🟢Quiz Questions:

Which concept allows DeFi apps to stack on each other?

🟢Choose one correct answer:

・Money Legos

・Money Stacks

・Financial Legos

・Financial Stacks

🟢Answer:

Money Legos

🟢Reason for choosing this answer:

The term “Money Legos” is widely used in the DeFi (Decentralized Finance) ecosystem to describe how DeFi protocols are composable. This means they can be combined like building blocks—just like Lego pieces—allowing developers to create more complex financial applications by stacking various DeFi tools and services.

🟢Trivia:

The “Money Legos” concept was popularized by Ethereum-based projects, especially during the DeFi boom of 2020. It underscores the open-source and interoperable nature of DeFi, where one application (e.g., lending) can be built on top of another (e.g., decentralized exchange) to create innovative financial products without the need for centralized intermediaries.

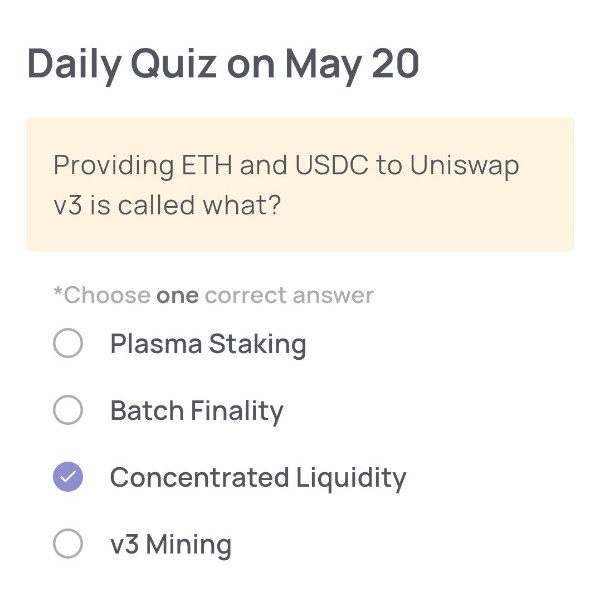

Daily Quiz on MAY 20

🟢Quiz Questions:

Providing ETH and USDC to Uniswap v3 is called what?

🟢Choose one correct answer:

・Plasma Staking

・Batch Finality

・Concentrated Liquidity

・v3 Mining

🟢Answer:

Concentrated Liquidity

🟢Reason for choosing this answer:

Uniswap v3 introduced the concept of concentrated liquidity, allowing liquidity providers (LPs) to allocate liquidity within custom price ranges. This innovation improves capital efficiency by letting LPs choose the price range where they want their assets (like ETH and USDC) to be active. Other options like “Plasma Staking” and “Batch Finality” are unrelated to liquidity provision, and “v3 Mining” is not an official term used for this function.

🟢Trivia:

With concentrated liquidity, LPs can earn more fees using less capital, but they also face a higher risk of impermanent loss if the market price moves out of their specified range. This system makes Uniswap v3 more flexible and powerful compared to its predecessors.

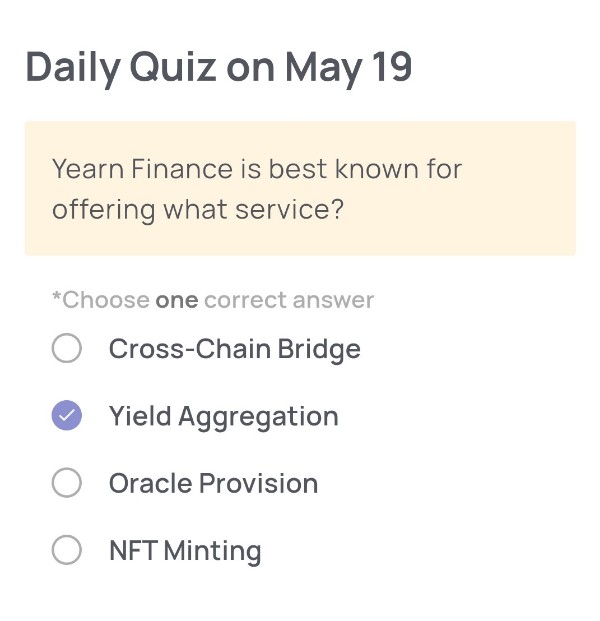

Daily Quiz on MAY 19

🟢Quiz Questions:

Yearn Finance is best known for offering what service?

🟢Choose one correct answer:

・Cross-Chain Bridge

・Yield Aggregation

・Oracle Provision

・NFT Minting

🟢Answer:

Yield Aggregation

🟢Reason for choosing this answer:

Yearn Finance is a decentralized finance (DeFi) protocol built on Ethereum, and it is best known for its yield aggregation services. The platform automates the process of finding the best yield farming opportunities across DeFi protocols. It collects user deposits and allocates them across different DeFi strategies to maximize returns, hence the term “yield aggregator.”

🟢Trivia:

The core product of Yearn Finance is the “Vault”, where users deposit assets, and the protocol automatically implements strategies to generate the highest yield. Yearn Finance gained massive popularity in 2020 and its native token, YFI, was notable for having no premine and being distributed entirely to users, embodying decentralization.

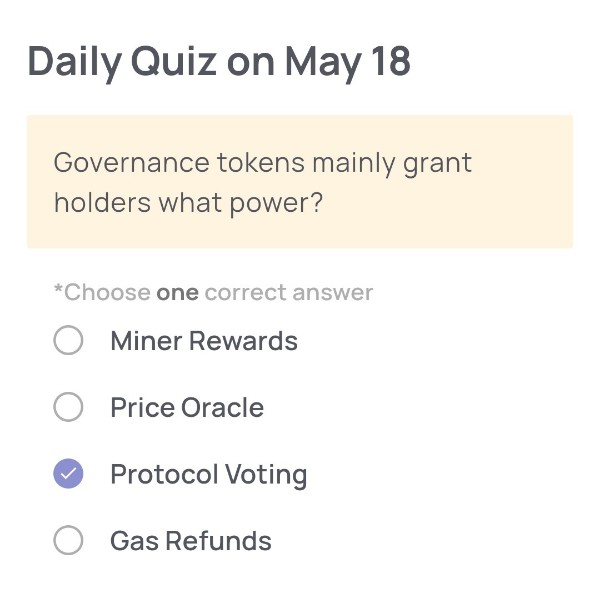

Daily Quiz on MAY 18

🟢Quiz Questions:

Governance tokens mainly grant holders what power?

🟢Choose one correct answer:

・Miner Rewards

・Price Oracle

・Protocol Voting

・Gas Refunds

🟢Answer:

Protocol Voting

🟢Reason for choosing this answer:

Governance tokens empower holders to influence the future of a blockchain protocol by allowing them to vote on key decisions. This may include upgrades, fee structures, development fund allocations, or other essential protocol parameters. The purpose is to enable decentralized, user-driven governance without relying on a centralized authority.

🟢Trivia:

Representative governance tokens include Uniswap’s UNI and Compound’s COMP. UNI holders can vote on proposals concerning liquidity mining rewards, fee structures, and treasury usage. COMP holders participate in decisions about interest rate models or adding new assets to the platform.

In Xenea, the native token XENE also functions as a governance token. It is designed to be used in voting on Xenea Improvement Proposals (CIP), which may involve changes to network parameters and economic models such as the inflation rate. This framework empowers users and fosters true decentralized governance within the Web3 ecosystem.

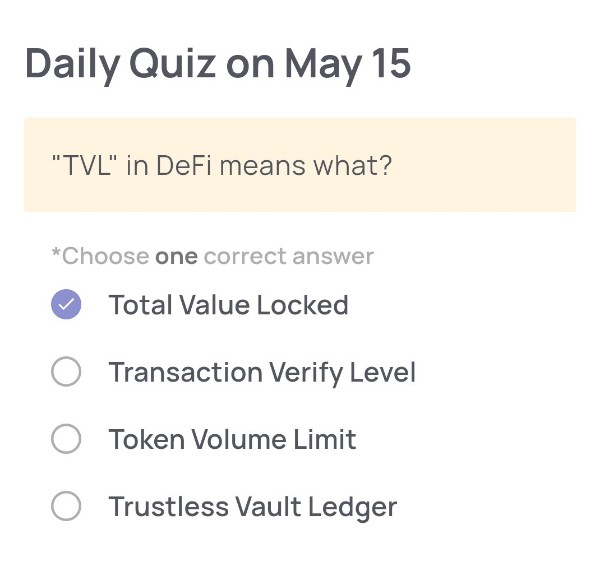

Daily Quiz on MAY 15

🟢Quiz Questions:

“TVL” in DeFi means what?

🟢Choose one correct answer:

・Total Value Locked

・Transaction Verify Level

・Token Volume Limit

・Trustless Vault Ledger

🟢Answer:

Total Value Locked

🟢Reason for choosing this answer:

“TVL” stands for Total Value Locked, which refers to the total amount of assets that are currently staked or locked in a DeFi (Decentralized Finance) protocol. This metric helps assess the overall health, usage, and popularity of a DeFi platform, as it reflects the total capital committed by users.

🟢Trivia:

TVL is commonly used to compare DeFi platforms such as Uniswap, Aave, and Compound. A higher TVL often indicates higher user trust and platform liquidity. However, it’s important to note that TVL alone doesn’t guarantee the safety or profitability of a platform—it should be considered along with other metrics like user count, tokenomics, and smart contract audits.

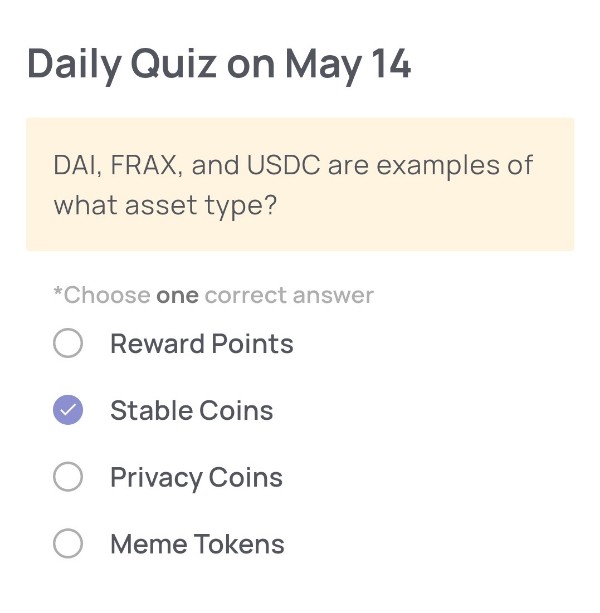

Daily Quiz on MAY 14

🟢Quiz Questions:

DAI, FRAX, and USDC are examples of what asset type?

🟢Choose one correct answer:

・Reward Points

・Stable Coins

・Privacy Coins

・Meme Tokens

🟢Answer:

Stable Coins

🟢 Reason for choosing this answer:

DAI, FRAX, and USDC are all categorized as stablecoins—a type of cryptocurrency designed to maintain a stable value, often pegged to a fiat currency like the US Dollar. Unlike other cryptocurrencies that can be highly volatile, stablecoins aim to provide price stability, making them useful for trading, remittances, and daily transactions.

🟢 Trivia:

Stablecoins can be categorized into three types:

1. Fiat-collateralized (e.g., USDC) – backed by reserves like USD held in a bank.

2. Crypto-collateralized (e.g., DAI) – backed by other cryptocurrencies.

3. Algorithmic (e.g., FRAX originally used a hybrid approach) – rely on algorithms to control supply and demand.

These assets are playing a vital role in bridging traditional finance and decentralized finance (DeFi).

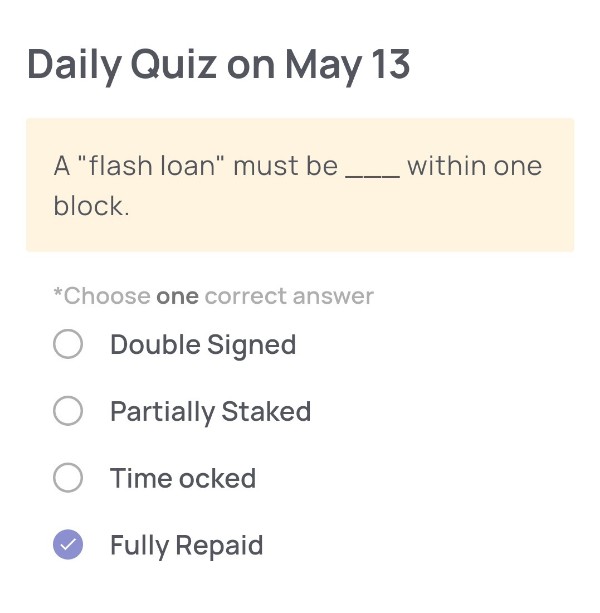

Daily Quiz on MAY 13

🟢Quiz Questions:

A “flash loan” must be block. within one

🟢Choose one correct answer:

・Double Signed

・Partially Staked

・Time ocked

・Fully Repaid

🟢Answer:

Fully Repaid

🟢Reason for choosing this answer:

Flash loans are a unique feature of decentralized finance (DeFi) that allow users to borrow assets without collateral, under the condition that the loan is repaid within the same blockchain transaction (i.e., within one block). If the borrower fails to repay the loan in full within the block, the entire transaction is reverted, as if it never happened. Therefore, “Fully Repaid” is the correct answer.

🟢Trivia:

Flash loans are often used for arbitrage opportunities, collateral swaps, or refinancing purposes. However, they have also been exploited in DeFi hacks due to their speed and complexity. One notable case was the bZx protocol attack, where attackers manipulated asset prices within a single transaction using flash loans.

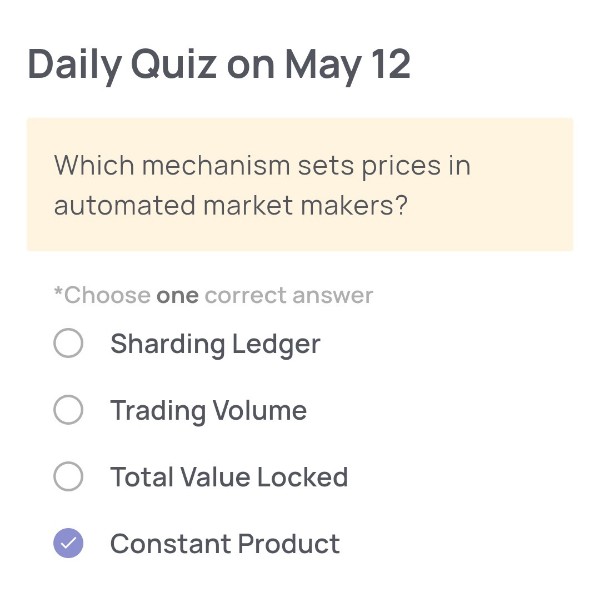

Daily Quiz on MAY 12

🟢Quiz Questions:

Which mechanism sets prices in automated market makers?

🟢Choose one correct answer:

・Sharding Ledger

・Trading Volume

・Total Value Locked

・Constant Product

🟢Answer:

Constant Product

🟢Reason for choosing this answer:

The pricing mechanism in automated market makers (AMMs) like Uniswap is based on the constant product formula, often represented as xy = k*, where x and y are the quantities of two tokens in a liquidity pool, and k is a constant. This ensures that as one token is bought and its supply decreases, its price increases in order to maintain the product constant. This model guarantees that the pool never runs out of either token, as price tends toward infinity as reserves dwindle.

🟢Trivia:

Uniswap was the first major decentralized exchange to popularize the constant product formula. This model laid the groundwork for a wide range of AMMs in the DeFi ecosystem. One interesting property of this formula is “slippage”—the more of a token you try to buy at once, the worse your rate becomes, due to the curve shape of the formula.

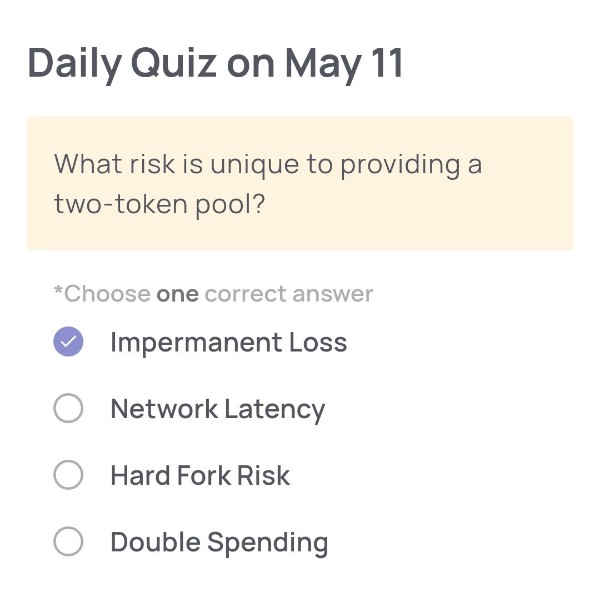

Daily Quiz on MAY 11

🟢Quiz Questions:

What risk is unique to providing a two-token pool?

🟢Choose one correct answer:

・Impermanent Loss

・Network Latency

・Hard Fork Risk

・Double Spending

🟢Answer:

Impermanent Loss

🟢Reason for choosing this answer:

Impermanent loss is a risk unique to providing liquidity in decentralized finance (DeFi), especially in two-token pools (like ETH/USDC) on automated market makers (AMMs) such as Uniswap. It occurs when the price ratio of the two tokens changes after you’ve deposited them, resulting in a potential loss when you withdraw them compared to simply holding the tokens.

🟢Trivia:

Impermanent loss isn’t actually realized until you withdraw your tokens from the pool. If the token prices return to their original ratio, the loss can disappear—hence the term “impermanent.” However, large price divergences can lead to significant and permanent losses if withdrawn at the wrong time. Some protocols, like Bancor and Curve, have introduced innovations to mitigate this risk.

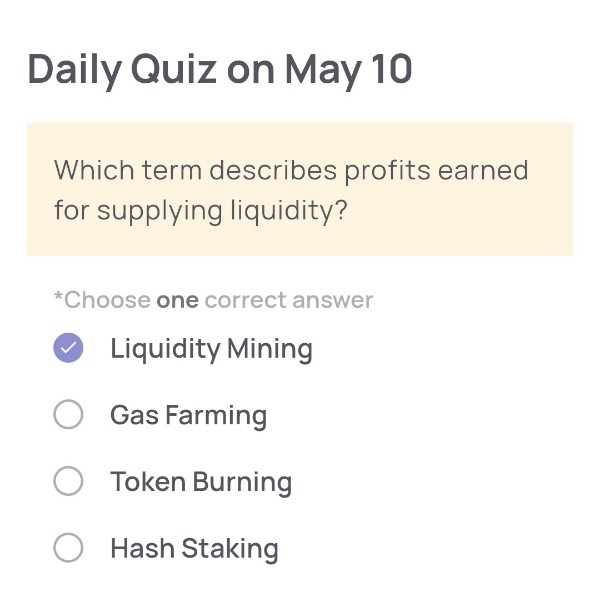

Daily Quiz on MAY 10

🟢Quiz Questions:

Which term describes profits earned for supplying liquidity?

🟢Choose one correct answer:

・Liquidity Mining

・Gas Farming

・Token Burning

・Hash Staking

🟢Answer:

Liquidity Mining

🟢Reason for choosing this answer:

“Liquidity Mining” refers to the process where users provide liquidity to decentralized finance (DeFi) protocols (usually by depositing their tokens into liquidity pools), and in return, they earn rewards. These rewards can be in the form of transaction fees, interest, or additional tokens, and represent the “profits earned for supplying liquidity.” The other options relate to different aspects of blockchain and crypto systems but not directly to liquidity provisioning profits.

🟢Trivia:

The concept of liquidity mining gained popularity with the rise of DeFi platforms like Uniswap and Compound. It not only incentivizes users to provide liquidity but also helps projects distribute their tokens more fairly by rewarding early contributors. Some protocols even offer “double rewards” – native tokens plus governance tokens – for extra incentives.

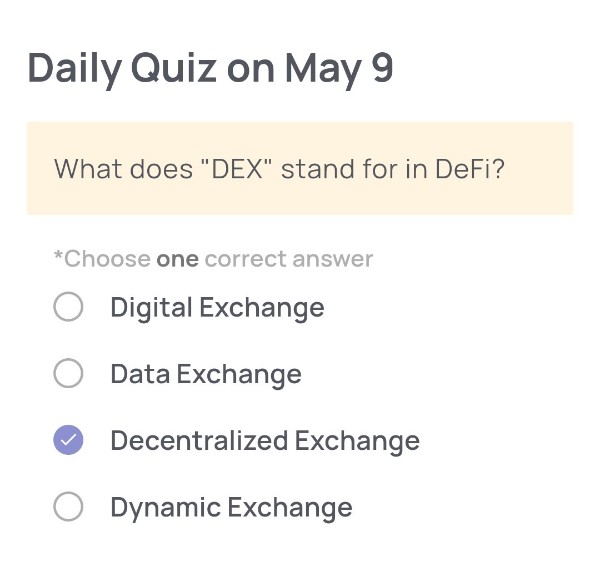

Daily Quiz on MAY 9

🟢Quiz Questions:

What does “DEX” stand for in DeFi?

🟢Choose one correct answer:

・Digital Exchange

・Data Exchange

・Decentralized Exchange

・Dynamic Exchange

🟢Answer:

Decentralized Exchange

🟢Reason for choosing this answer:

In the context of DeFi (Decentralized Finance), “DEX” stands for “Decentralized Exchange.” These platforms operate without a central authority, enabling peer-to-peer trading of cryptocurrencies using smart contracts. This decentralized model improves security and user control over assets compared to centralized exchanges.

🟢Trivia:

Xenea is preparing to support DEX functionality through its EVM-compatible Layer 1 blockchain. Thanks to its integration with Decentralized Autonomous Content Storage (DACS) and use of the PoD (Proof of Democracy) consensus mechanism, Xenea provides a secure, scalable foundation for future decentralized applications, including DEXs. Developers can build DEXs on Xenea while leveraging its unique architecture that ensures data persistence and user-centric governance.

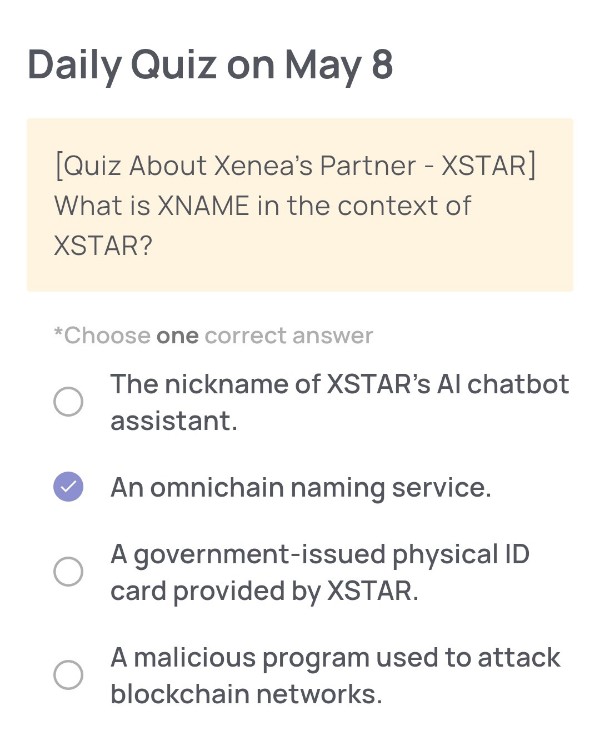

Daily Quiz on MAY 8

🟢Quiz Questions:

[Quiz About Xenea’s Partner – XSTAR] What is XNAME in the context of XSTAR?

🟢Choose one correct answer:

・The nickname of XSTAR’s Al chatbot assistant.

・An omnichain naming service.

・A government-issued physical ID card provided by XSTAR.

・A malicious program used to attack blockchain networks.

🟢Answer:

・An omnichain naming service.

🟢Reason for choosing this answer:

Based on XSTAR’s core mission of providing decentralized identity protocols and features such as Decentralized Identity Identifiers (DIDs) and Omnichain Identity Protocols, XNAME refers to its omnichain naming service. This aligns with their goal of enabling seamless cross-platform identity integration and human-centric digital presence in the decentralized ecosystem.

🟢Trivia:

XSTAR’s identity system is not just about names—it supports Proof of Humanity (PoH) using social graphs, biometric data, and adaptive scoring to ensure users are real and unique. It’s a crucial step in combating AI-generated identities and Sybil attacks in Web3 platforms.

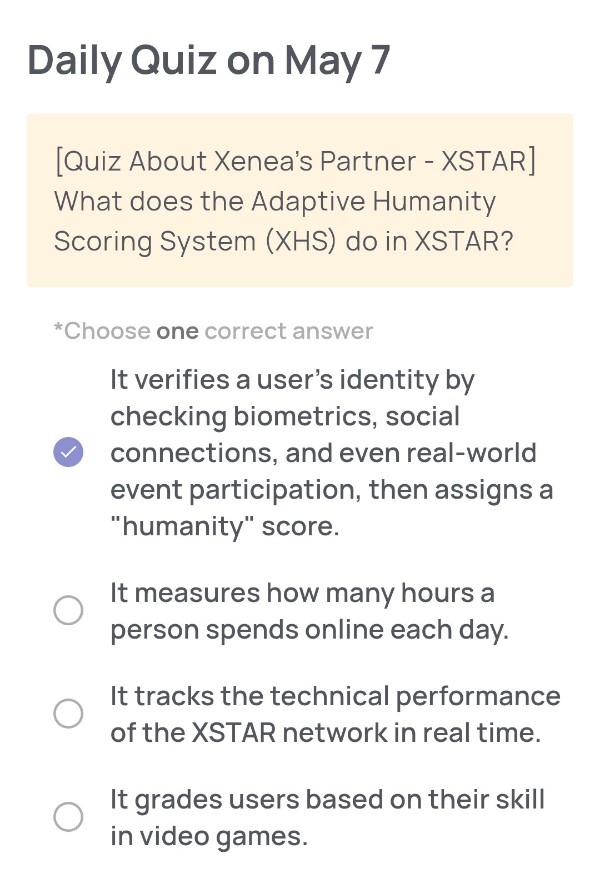

Daily Quiz on MAY 7

🟢Quiz Questions:

[Quiz About Xenea’s Partner – XSTAR] What does the Adaptive Humanity Scoring System (XHS) do in XSTAR?

🟢Choose one correct answer:

・It verifies a user’s identity by checking biometrics, social connections, and even real-world event participation, then assigns a “humanity” score.

・It measures how many hours a person spends online each day.

・It tracks the technical performance of the XSTAR network in real time.

・It grades users based on their skill in video games.

🟢Answer:

It verifies a user’s identity by checking biometrics, social connections, and even real-world event participation, then assigns a “humanity” score.

🟢Reason for choosing this answer:

According to official documentation on the Xenea x XSTAR partnership, the Adaptive Humanity Scoring System (XHS) within XSTAR is designed to authenticate individuals securely and privately by integrating biometric verification, social linkage, and real-world event participation. This system combats synthetic identities and AI fraud by assigning a unique “humanity score” to each user.

🟢Trivia:

XHS plays a crucial role in Proof of Humanity (PoH) systems and is expected to be a key mechanism for mitigating Sybil attacks in decentralized ecosystems. It enables only real, verified human users to participate in sensitive Web3 activities, such as governance or incentive campaigns—thereby increasing trust and fairness in decentralized applications.

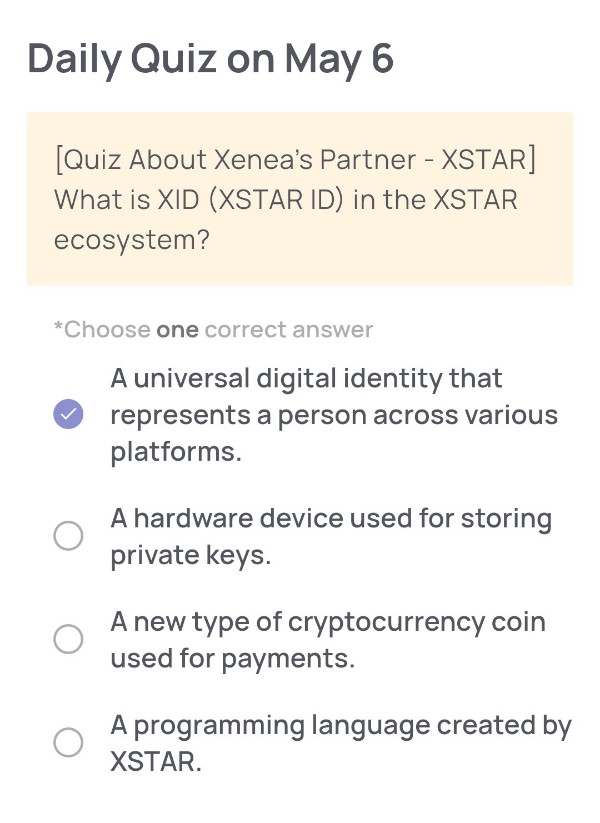

Daily Quiz on MAY 6

🟢Quiz Questions:

[Quiz About Xenea’s Partner – XSTAR] What is XID (XSTAR ID) in the XSTAR ecosystem?

🟢Choose one correct answer:

・A universal digital identity that represents a person across various platforms.

・A hardware device used for storing private keys.

・A new type of cryptocurrency coin used for payments.

・A programming language created by XSTAR.

🟢Answer:

A universal digital identity that represents a person across various platforms.

🟢Reason for choosing this answer:

XID, or XSTAR ID, is described in the partnership materials between Xenea and XSTAR as a core part of XSTAR’s decentralized identity protocol. It represents a secure, privacy-preserving, and interoperable digital identity (also referred to as a Decentralized Identity Identifier, or DID), which allows users to verify their humanity and uniqueness across different platforms using components such as biometric data and social graph analysis.

🟢Trivia:

Xenea’s collaboration with XSTAR integrates this XID system into its own infrastructure, particularly within the Xenea Wallet and Decentralized Autonomous Content Storage (DACS). This means that users of Xenea will soon be able to enjoy enhanced security and interoperability by using XID to authenticate themselves across multiple decentralized applications, paving the way for seamless user experiences and protection against Sybil attacks.

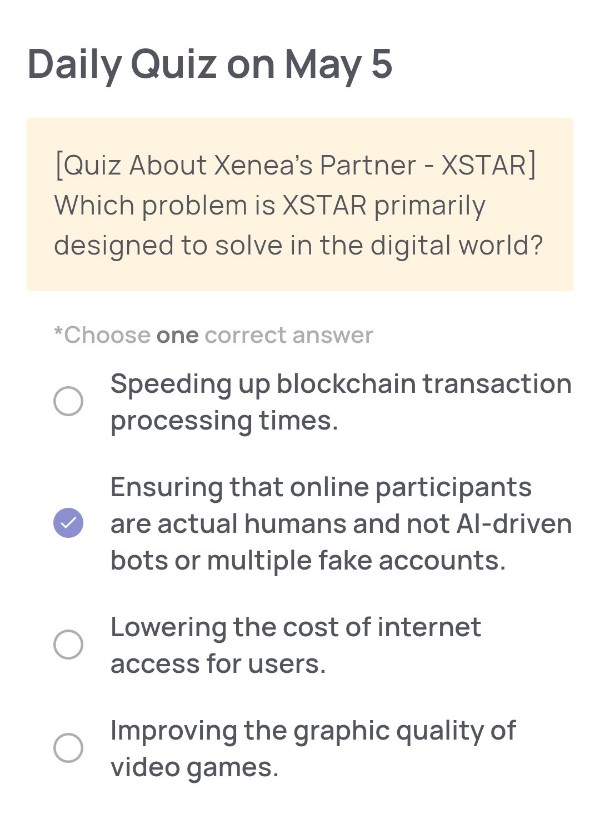

Daily Quiz on MAY 5

🟢Quiz Questions:

[Quiz About Xenea’s Partner – XSTAR]

Which problem is XSTAR primarily designed to solve in the digital world?

🟢Choose one correct answer:

・Speeding up blockchain transaction processing times.

・Ensuring that online participants are actual humans and not Al-driven bots or multiple fake accounts.

・Lowering the cost of internet access for users.

・Improving the graphic quality of video games.

🟢Answer:

Ensuring that online participants are actual humans and not Al-driven bots or multiple fake accounts.

🟢 Reason for choosing this answer:

XSTAR focuses on decentralized identity protocols, particularly in the area of Proof of Humanity (PoH). Its core technology includes an “adaptive humanity scoring system” that authenticates individuals to ensure they are real and unique, specifically addressing the issue of synthetic identities and AI-generated fraud.

🟢 Trivia:

The partnership between Xenea and XSTAR combines XSTAR’s secure identity verification protocols with Xenea’s Decentralized Autonomous Content Storage (DACS). This integration not only protects against fake users but also ensures that verified user data is stored safely and sustainably on the Xenea blockchain. By leveraging Xenea’s native features like EVM compatibility and on-chain storage, the collaboration sets a new standard for secure, human-centric Web3 ecosystems.

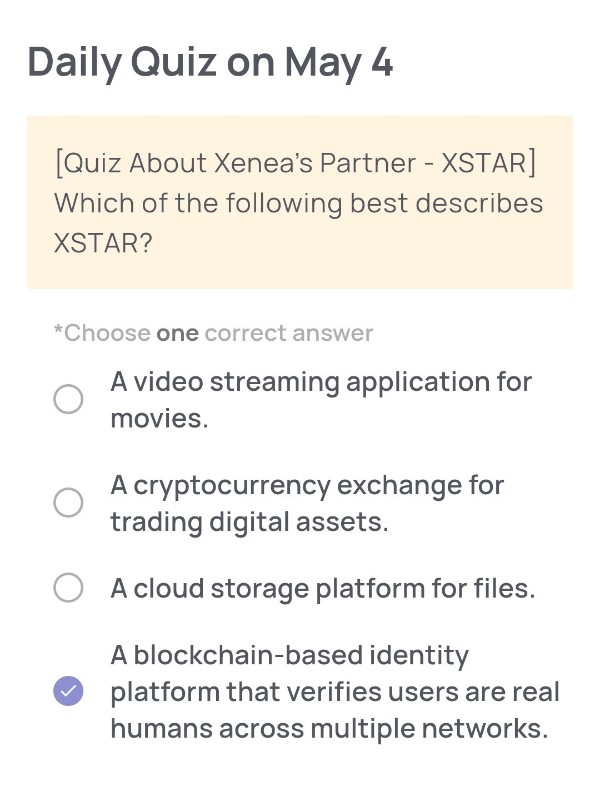

Daily Quiz on MAY 4

🟢Quiz Questions:

[Quiz About Xenea’s Partner – XSTAR] Which of the following best describes XSTAR?

🟢Choose one correct answer:

・A video streaming application for movies.

・A cryptocurrency exchange for trading digital assets.

・A cloud storage platform for files.

・A blockchain-based identity platform that verifies users are real humans across multiple networks.

🟢Answer:

・A blockchain-based identity platform that verifies users are real humans across multiple networks.

🟢Reason for choosing this answer:

XSTAR is described as a leader in decentralized identity protocols focused on Proof of Humanity (PoH). It features components such as Decentralized Identity Identifiers (DIDs), biometric verification, social graph analysis, and an adaptive humanity scoring system. These technologies collectively ensure that users are real, unique individuals across networks, which aligns exactly with the answer describing XSTAR as “a blockchain-based identity platform that verifies users are real humans across multiple networks”.

🟢Trivia:

XSTAR’s system plays a crucial role in mitigating Sybil attacks—scenarios where one entity pretends to be multiple users in a network. By integrating with Xenea’s decentralized data storage (DACS), XSTAR strengthens identity verification and security, enabling more trustworthy decentralized applications (dApps) and governance.

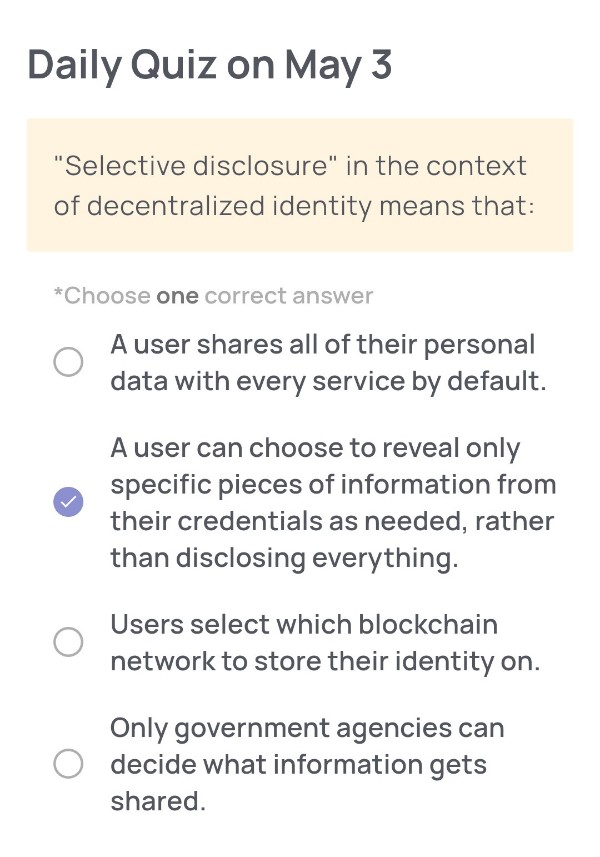

Daily Quiz on MAY 3

🟢Quiz Questions:

“Selective disclosure” in the context of decentralized identity means that:

🟢Choose one correct answer:

・A user shares all of their personal data with every service by default.

・A user can choose to reveal only specific pieces of information from their credentials as needed, rather than disclosing everything.

・Users select which blockchain network to store their identity on.

・Only government agencies can decide what information gets shared.

🟢Answer:

A user can choose to reveal only specific pieces of information from their credentials as needed, rather than disclosing everything.

🟢Reason for choosing this answer:

Selective disclosure enables users to protect their privacy by only revealing the necessary data for a specific use case. This is especially important in decentralized systems where users retain ownership of their identity and data. By minimizing data exposure, users can mitigate risks such as identity theft and data misuse.

🟢Trivia:

Xenea is actively working toward integrating decentralized identity solutions into its ecosystem. Through its partnership with XSTAR, Xenea supports Decentralized Identifiers (DIDs) and Proof of Humanity (PoH) mechanisms. These technologies empower users with full control over their personal data and enable selective disclosure of identity information stored securely using Xenea’s DACS (Decentralized Autonomous Content Storage). This approach ensures both privacy and security while promoting a user-centric Web3 experience.

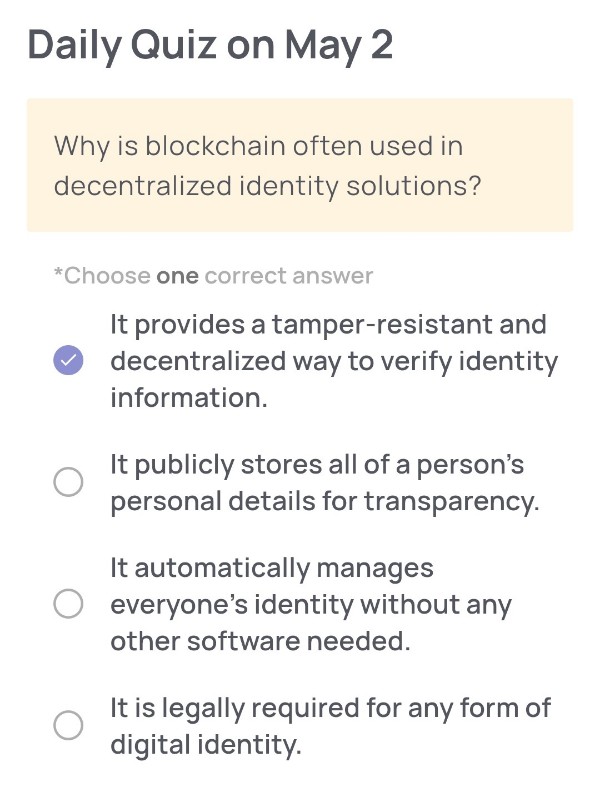

Daily Quiz on MAY 2

🟢Quiz Questions:

Why is blockchain often used in decentralized identity solutions?

🟢Choose one correct answer:

・It provides a tamper-resistant and decentralized way to verify identity information.

・It publicly stores all of a person’s personal details for transparency.

・It automatically manages everyone’s identity without any other software needed.

・It is legally required for any form of digital identity.

🟢Answer:

It provides a tamper-resistant and decentralized way to verify identity information.

🟢Reason for choosing this answer:

Blockchain technology offers an immutable ledger and decentralized architecture, making it ideal for verifying identity in a secure and trustworthy way. Since each identity entry is cryptographically recorded and validated by a distributed network, it minimizes risks of tampering, forgery, and central authority abuse—making it a powerful foundation for decentralized identity (DID) systems.

🟢Trivia:

Projects like Xenea are integrating DID protocols (e.g., via XSTAR partnership) into their decentralized infrastructure to enable secure identity verification using technologies like Decentralized Identifiers (DIDs) and Proof of Humanity (PoH). This ensures both data integrity and user sovereignty, while resisting Sybil attacks and fraud.

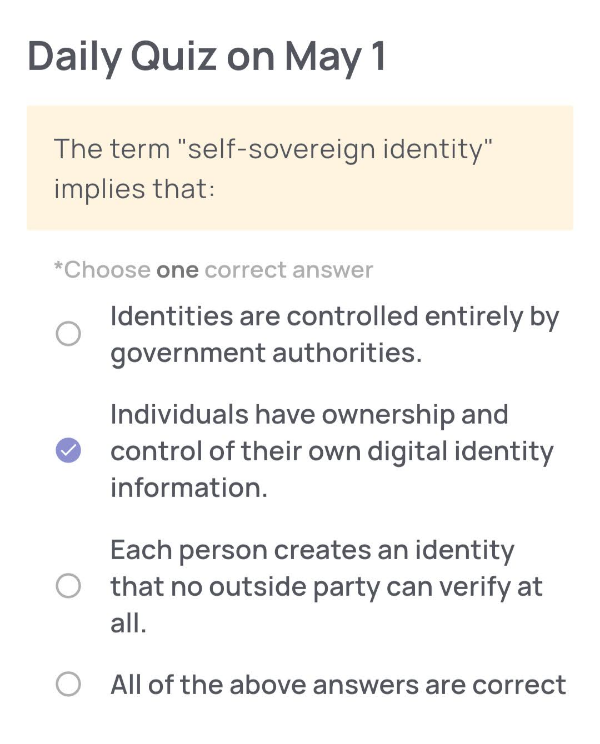

Daily Quiz on MAY 1

🟢Quiz Questions:

The term “self-sovereign identity” implies that:

🟢Choose one correct answer:

・Identities are controlled entirely by government authorities.

・Individuals have ownership and control of their own digital identity information.

・Each person creates an identity that no outside party can verify at all.

・All of the above answers are correct

🟢Answer:

Individuals have ownership and control of their own digital identity information.

🟢Reason for choosing this answer:

“Self-sovereign identity” (SSI) refers to a model where individuals maintain complete control over their digital identities, without relying on centralized authorities like governments or corporations. This model enables users to selectively share credentials and data, improving privacy and reducing dependence on third-party verifications. The other options are incorrect because SSI does not imply exclusive government control or unverifiable identities.

🟢Trivia:

SSI systems often utilize Decentralized Identifiers (DIDs) and blockchain technology to manage identities securely and verifiably. For example, platforms like Xenea, in partnership with identity providers such as XSTAR, aim to integrate SSI principles with scalable, decentralized data storage and Proof of Humanity, empowering users to control their digital presence and identity within Web3 ecosystems.

Comment